Expat Tax 101: US Source Income and Foreign Source Income

December 21, 2023 | Foreign Earned Income | 4 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated December 17, 2024

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated December 17, 2024

In the US expat community, much is discussed about the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC). IRS tax rules for both stipulate that the income being excluded or used for credit must be sourced from abroad. However, determining your income source can be tricky, particularly in distinguishing between US-source income and foreign-source income. Here’s a concise summary of both our and foreign-sourced income to help clarify the distinction.

Where Is Your Income Earned?

In general, the IRS classifies that earned income based on where it is earned. To put it simply:

- if you’re working abroad = your income is considered foreign-earned

- if you’re working in the US = your income is considered US-earned

This also holds true whether the US or a foreign company is paying you while you are in the US.

We’ll give you an example to illustrate this point:

Mark is a US citizen abroad, living in Barcelona, Spain. He works for Proctor and Gamble. In this scenario, his income can be classified as foreign earned income because he is working abroad. Quite straight forward.

Once a year, Mark takes a business trip back to the US for Proctor and Gamble. The income earned on this business trip cannot be excluded as foreign earned income, because it was not earned abroad. Mark was working in the US during the business trip. So US source income is going to be computed based on the time he works in the US.

Even if Mark was always paid in a foreign currency and it was always deposited into his foreign bank account, this portion of his US earned income will have to be separated out from his foreign earned income exclusion claim (the FEIE).

If this is still complicated, don’t fret. When you walk through MyExpatTaxes software, you’ll be able to easily determine which is US source income and foreign source income.

We’ll also make sure to use a Tax Treaty if possible to resource this US-earned income if required so you can at least use Foreign Tax Credits!

All Worldwide Income Must Be Reported

This difference is important to note because all your income earned worldwide must be reported on your US tax return, if you make over the tax filing threshold. This is used to report both foreign and US-earned income.

However, it doesn’t always mean you’ll have to pay taxes on foreign-earned income. There are several tax considerations that can be applied:

- Foreign Earned Income Exclusion is an expat tax benefit that allows you to exclude $120,000 of foreign earned income.

- Foreign Tax Credit, which prevents you from being double-taxed on your foreign income.

However, keep in mind that everyone’s tax situation is different. If you have foreign-earned income on your tax return, be sure to consider all the possibilities that are available to you to mitigate any potential tax complications.

US State Taxes and Earned Income

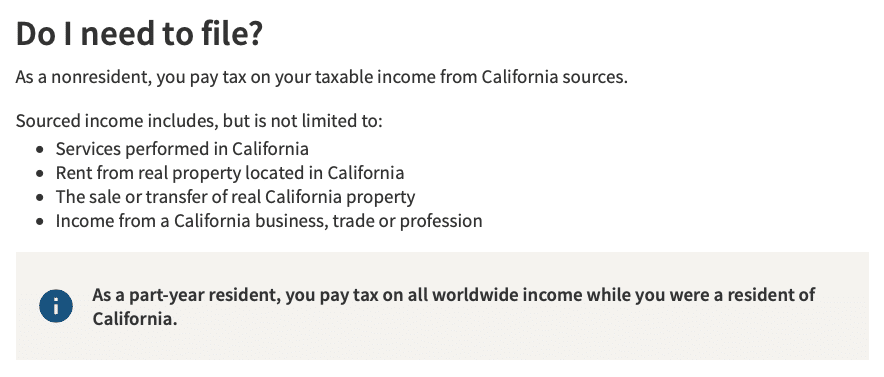

Every state has different filing requirements for Part-Year / Non-Residents. If you have a lot of US-sourced income that is connected to a particular state, you may be required to file a State Tax Return even if you don’t live there anymore.

For example, California has one of the strictest Non-Resident filing requirements for Americans overseas:

California source income includes, but is not limited to:

+ Services performed in California

+ The sale or transfer of real California property

+ Rent from real property located in California

+ Income from a California business, trade or profession

See California filing thresholds and requirements.

State of California Tax Franchise Board

As you can see, as a resident of a foreign country and working in California (non-resident), you must pay tax on your taxable income from California sources.

This goes for being a US American who for example, has a tax home/lives overseas but took a business trip in Los Angeles. Even if they only working in California for a few days. Why?

- They have at least $1 of California Sourced Income

- Their gross worldwide income (US and Foreign) is over the filing income threshold listed above

If you’re working outside of California but within another U.S. state as an American abroad, explore our useful US State Taxes guides. Discover details about state filing requirements and tax forms. If you don’t find your specific state listed, drop us a comment, and we’ll gladly create a tailored US state tax guide for you!

So, You Need To File?

Does figuring out US source income and foreign source income seem confusing? We understand. We know that tax terminology and the tax season are extremely stressful, especially when you live in the US – more so when living abroad! Hopefully, this summary of US and foreign source income gave you some insight to lessen the confusion.

It seems like all the software solutions out there forgot about us American expat taxpayers. And personalized services want to charge us upwards of $500 – $1,000+ just to file! This is why we founded MyExpatTaxes because we know that moving abroad is hard enough, but your taxes shouldn’t be…

You can walk through our Base plan for your federal taxes and FBAR. Get your US taxes done in as little as 30 minutes.

Or, if you need to catch up on missed federal tax returns, you can use our Streamlined Procedure. A Tax Professional can help you get back on track this tax year. We have one of the Internet’s most affordable tax amnesty pricing models.

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

December 21, 2023 | Foreign Earned Income | 4 minute read