Third Stimulus Check for Americans Abroad

March 19, 2021 | Stimulus Checks | 4 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated April 9, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated April 9, 2025

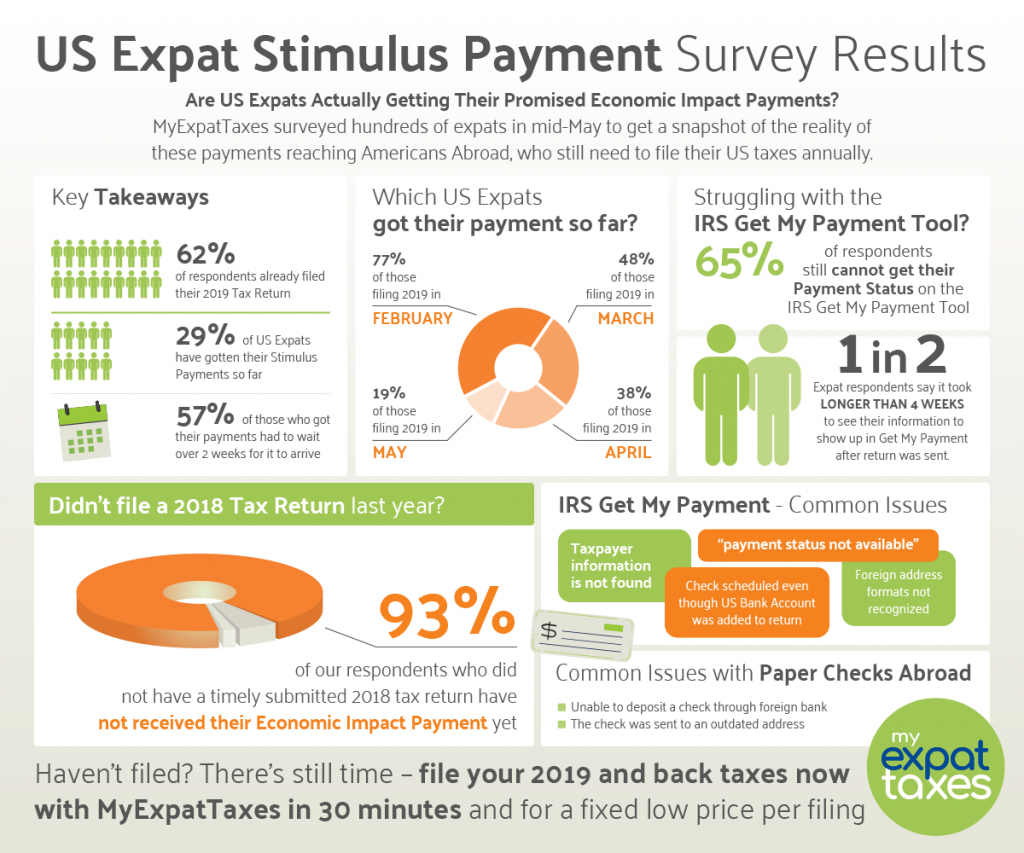

As of March 11, President Biden signed the American Rescue Plan into law – making the third stimulus check for Americans living abroad possible. The American Rescue Plan is a monetary relief for American families during the COVID-19 pandemic.

We get many questions regarding the third stimulus check and how you, as an expat can benefit it. To see a complete timeline of how the third stimulus check rolled out, read our expat tax guide. Here we will share everything you need to know about the third stimulus check for Americans abroad.

Who Can Receive the Third Stimulus Check

Generally, qualifying for the third economic impact payment is the same as the second check. However, the price has increased for 2021:

- $1,400 for US citizen individuals

- $2,800 for US couples who file jointly

US citizens in the States and abroad can receive the third stimulus check if they have adjusted gross income (AGI) up to $75,000 as an individual or $150,000 as a married couple filing jointly. Head of household filers can receive the check if their AGI is under $112,500.

Additionally, $1,400 goes to each dependent, even if they are over 17 and with a valid Social Security number. For the first time, the elderly and disabled adults who depend on relatives can receive this money.

For those whose adjusted gross income is over the threshold, the stimulus check will reduce until the cut-off line (e.g., $80,000 for individual persons and $160,000 for married couples filing jointly).

If you’re an American expat married to a non-US person, you can also receive the third stimulus check.

When Can Expats Receive the Third Stimulus Check

The White House press secretary Jen Psaki announced on March 11 that the first wave of checks would be deposited into US bank accounts the coming weekend. Therefore, expats can receive their stimulus checks by direct deposit if they have already received the first two checks and/or have already filed their 2020 tax return.

These checks should be coming in fast for US citizens. You can check the status of when you will be receiving yours on the IRS Get my Payment page.

What Can Expats do to Receive the Third Stimulus Check

If you already filed your 2020 tax return and/or received the first two stimulus payments, you don’t need to do anything. The IRS will deposit the check into the US bank account you placed on your tax return. If you didn’t add this information, you should receive a paper check by mail.

Catching up on expat taxes to get the stimulus check

Some US citizens abroad need to catch up on their US taxes to receive one or all of the stimulus payments. You can utilize our Streamlined Procedure service to file taxes fast, effectively, and for an affordable price! To qualify, you need to have lived outside the US for at least 330 days, haven’t filed a tax return in at least three years, and more.

Once you’re caught up on your US taxes, you should see the qualified stimulus checks in your bank account or paper check.

Unemployment Benefits from Stimulus Checks

Under the American Rescue Plan, $102,000 of unemployment benefits can be subtracted from $150,000 of annual household income and excluded from US taxation. MyExpatTaxes was one of the first tax software programs to implement this deduction the weekend after its announcement. If you need to amend your 2020 tax return to claim this benefit, you can surely use MyExpatTaxes to file your amendment.

Child Tax Credit

The American Rescue plans also increases the Child Tax Credit for US families in the States and abroad. This credit was from one of Biden’s proposals regarding this tax plan in 2020 and made this credit fully refundable.

Now, for 2021, the Child Tax Credit will:

- Become fully refundable – removing the $2,500 minimum income requirement (if you have lived in the US for at least one half of the year).

- Increase the credit amount to $3,600 for children 5 and under. Then, it’s $3,000 for children over 6.

- Phase out the tax credit for single filers who earn over $75,000 and married couples earning more than $150,000. Those who make above the thresholds but below $200,000 as a single filer ($400,000 for married couples) can still receive the original $2,000 Child Tax Credit.

- The plan gives periodic payments for qualified families to receive an advanced check from the IRS with up to half of the tax credit amount from July to December this year.

In addition to an increased stimulus check and Child tax credit amount, the American Rescue Plan offers more measures to support the American people like: Increasing the minimum wage, providing new loans to help small businesses, provide expanded paid sick leave, and more.

Receive the 2020 and 2021 Stimulus Payments

It’s possible you, as a US citizen abroad couldn’t qualify for the first and second stimulus checks. However, you may be able to this year in 2021!

Why? The value of stimulus checks is calculated from the previous years’ tax returns. Therefore, your 2020 tax return can be evaluated this year to see if you can claim stimulus payments.

However, you can only receive the first and second stimulus checks if you’ve claimed the FEIE or have had less income in 2020, which lessened your adjusted gross income. To see if you qualify for stimulus checks, you can check via our software!

Additionally, American citizens living abroad who typically don’t need to file but want to third stimulus check will need to file a 2020 tax return. In this case, you’ll be eligible for the Recovery Rebate Credit, which will lower the amount of US taxes you owe or increase your tax refund amount. You can only qualify for this credit if you did not receive the entire first $1,200 stimulus payment. As always, our helpful tax support team can help you figure this out!

Let’s Start 2020 Tax Season Right

Let’s get your tax filing done right. There is no better way than filing your US taxes and receiving your Stimulus checks than our user-friendly, simple expat tax software. We do our best to make the US expatriate process easy to understand (and, dare we say it, fun) for Americans abroad. Why not give us a shot?

File your expat taxes today and claim those stimulus checks so you can enjoy life as an American living abroad.

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

March 19, 2021 | Stimulus Checks | 4 minute read