Missed the US Expat Tax Deadline? Here’s What to Do

June 18, 2021 | Expat Tax Deadlines, The Streamlined Procedure | 4 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated November 26, 2024

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated November 26, 2024

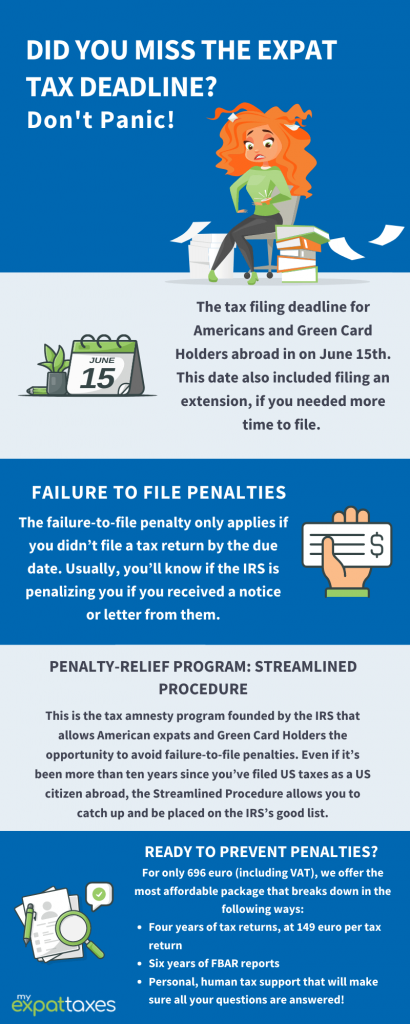

Have you missed the expat tax deadline or forgotten to file an extension? The general tax filing deadline for Americans and Green Card Holders abroad was on June 15th. This date also included filing an extension, if you needed more time to file.

Filing US taxes before the deadline is crucial because you’re not liable for penalty fees from the IRS. But if you’re a US expat and missed out – don’t panic just yet. In many cases, individuals who forgot their filing obligation may qualify for the IRS tax amnesty program called The Streamlined Procedure.

Failure to File Penalties

The failure-to-file penalty only applies if you didn’t file a tax return by the due date. Usually, you’ll know if the IRS is fining you if you received a notice or letter from them. In other cases, perhaps you’ve stumbled upon our blogs or found out from one of our partners about the tax deadline and realized you forgot to file.

In either case, the failure-to-file penalty from the IRS is calculated as:

…5% of the unpaid taxes for each month or part of a month that a tax return is late. The penalty won’t exceed 25% of your unpaid taxes.

IRS

Additionally, if your tax return is over 60 days late, the minimum failure-to-file penalty will be 100% of the tax required to be shown on your return, or $435 (whichever is less).

As you can see, the IRS charges interest on penalties. It’s not just one fee you as an American abroad must pay if you forgot to file. It is 5% interest that adds up month by month until it’s to 25%.

Here at MyExpatTaxes, we can help you pay or dispute due penalties in the safest, most affordable way. It all begins when you sign up via our app and reach out to one of our Tax Professionals.

Removing Penalties

There is a silver lining. It is possible the IRS can altogether remove your penalty if you missed the expat tax deadline. As long as you acted in good faith and have a reasonable cause for why you couldn’t file on time, you can qualify for penalty relief, like the Streamlined Procedure program.

Penalty-Relief Program: Streamlined Procedure

The Streamlined Procedure is a tax amnesty program founded by the IRS that allows American expats and Green Card Holders the opportunity to avoid failure-to-file penalties. It’s an effective process to walk through safely, legally, and correct past years of neglected returns.

Even if it’s been more than ten years since you’ve filed US taxes as a US citizen abroad, the Streamlined Procedure allows you to catch up and be placed on the IRS’s good list.

How to Qualify for Streamlining

Here’s a handy list to see if you qualify for Streamlining:

- You have not filed a US federal tax return in the last three years

- You didn’t live in a home, within the United States, over the past three years

- Have not filed amended or delinquent tax returns in the past

- Were residing outside the United States for at least 330 days within a year out of the last three years

- Have not filed a Foreign Bank Account Report (FBAR) in the last six years

Additionally, an essential aspect in qualifying for Streamlining is that your failure-to-file situation must be innocent. Meaning, you honestly forgot or didn’t know you had a file, or a family emergency happened that prevented you from doing so.

If you can attest that you didn’t file a tax return because of non-willful conduct, you can sign Form 14653, Certification by US Person Residing Outside of the US. This form is also found in our software.

Are you qualified to use the Streamlined Procedure? The next step is to use our affordable expat tax software, so you never have to worry about late filing penalties again.

Beginning the Streamlined Procedure

To begin the Streamlined Procedure, you can sign up on our US tax software for expats. Start by walking through our app, which will intuitively guide you every step of the way.

Secondly, you need to know certain information (Social Security Number, worldwide earned income from past four years, etc.). This also includes having information about the money in your foreign bank accounts the last six years – but only if you exceeded $10,000 or more in total at any one time during each of those years.

We’re proud our software offers the most affordable Streamlined package and can accommodate prior-year returns for filing!

First-Time Penalty Abatement

Did you already receive a notice from the IRS? There is another possible way to gain penalty relief from an unfiled/missed tax return. It’s called the IRS’s First Time Penalty Abatement policy, and you qualify if the following are true:

– You didn’t previously have to file a return, or you have no penalties for the three tax years before the tax year in which you received a penalty.

– You filed all currently required returns or filed an extension of time to file.

– You have paid, or arranged to pay, any tax due.

IRS

If you qualify for the above penalty relief, you can call the toll-free number on your IRS notice to clear the issue. And if your request for relief wasn’t granted, you can appeal via the IRS’s website.

Most Affordable Streamlined Procedure

For only 749€ (including VAT), the MyExpatTaxes tax filing software offers the most affordable Streamlined program that breaks down in the following ways:

- Four years of tax returns, at 149€ per tax return

- If need be, six years of FBAR reports

- Personal, human tax support that will make sure all your questions are answered

“Never knew getting my taxes up-to-date would be so easy.”

Kelly, expat in the UK, Streamlining user.

Ready to prevent penalties coming to you because you missed the expat tax deadline? File the Streamlined Procedure to clear your US expat taxes today!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

June 18, 2021 | Expat Tax Deadlines, The Streamlined Procedure | 4 minute read