The Top 6 Tax Forms for US Expats to Know

September 24, 2024 | Paying Taxes, Tax Forms | 6 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated December 27, 2024

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated December 27, 2024

At MyExpatTaxes, our aim is to simplify filing your taxes. No matter where in the world you live. To help in the process, we’ve put together this collection containing a brief outline of the most relevant IRS tax forms for expats.

Chances are, you won’t be required to file every single one of these IRS tax forms, but you will need at least some of them as an expat. We want to make sure you know what each tax form is and where to find it. Keep reading, it could save you some money in the end!

| Our Top 6 Expat Tax Forms | Other Important Tax Forms |

|---|---|

| The FBAR | 1040 |

| FATCA | Schedules 1-3 |

| Form 1116 | Schedules A-E |

| Form 2555 | Schedule 8812 |

| Form 8833 | Schedule SE |

| Form 4868 | State Tax Forms |

Six Tax Forms for Expats to Know

These first six tax forms may be new to you if you’ve never filed as a US expat before. They’ll help you avoid double taxation, report your foreign assets, and request an extension if you need more time.

1. The FBAR

Also known as the Foreign Bank Account Report, the FBAR is a must-know for Americans abroad. That’s because if you live and work outside the United States, chances are high you also hold a bank account outside the US. If the total max balance you have in any number of foreign accounts combined reaches $10,000 throughout the year, you need to report that. You’ll need to file FinCEN form 114 and report each account you hold outside the United States.

Oh, and by the way, MyExpatTaxes is the only Expat tax service that includes the FBAR at no extra cost.

Read: Do I need to File an FBAR?

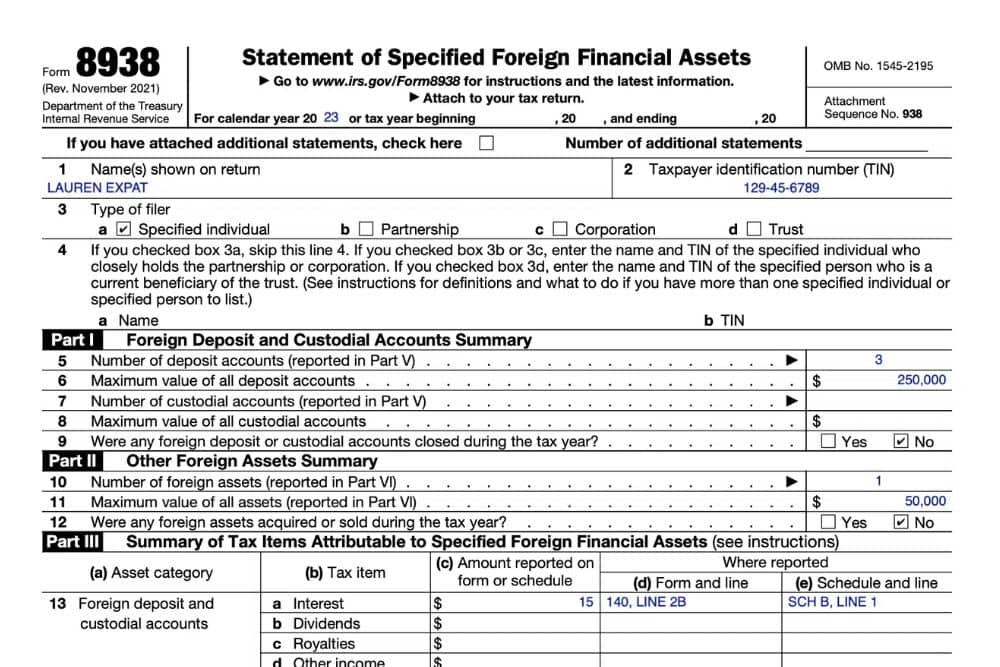

2. FATCA

Another term to get familiar with is FATCA. Unfortunately, if you hold foreign bank accounts, you could once again be reporting those. FATCA stands for Foreign Account Tax Compliance Act. In 2010, the HIRE Act was passed, which included legislation that foreign financial institutes had to report the high-value accounts of American account holders.

As an individual, you’ll be required to File Form 8938 if the total amount you hold in foreign accounts reaches at least $50,000 at any time throughout the year while living in the US.

As a US Citizen living abroad, your threshold is higher. You only have to report your financial accounts via FATCA if the total amount you hold is $200,000 on the last day of the tax year or more than $300,000 at any time during the year. If you’re married filing jointly, those minimum goes up. You’ll need to report if your foreign accounts hold $400,000 on the last day of the tax year or more than $600,000 at any time during the year.

Why are you required to report your foreign accounts twice? The FBAR is being reported to the Financial Crimes Enforcement Network, while FATCA is an IRS report. Do not skip over either of these. When it comes to IRS Tax Forms for Expats, these are probably the top two that Americans miss!

Read: More about FATCA for expats

3. Form 1116 – The Foreign Tax Credit

Form 1116 is the second of the two ways I mentioned that US Citizens could avoid double taxation. If you’ve paid income taxes to a foreign country, you may be able to get credit for those taxes paid. Calculating your Foreign Tax Credit shouldn’t be too hard. Overall, you’ll want to make sure you receive credit for taxes you’ve already paid, so you don’t have to pay those taxes to the US as well.

Remember, the Foreign Tax Credit is not the same as the Foreign Earned Income Exclusion. If you need to, you can even use both!

4. Form 2555 – The Foreign Earned Income Exclusion.

Speaking of the Foreign Earned Income Exclusion, or FEIE for short, if you live abroad, chances are good you have foreign income. The FEIE is one of the two main ways expats avoid double taxation. By filing Form 2555, you can exclude up to $126,500 of income from your 2024 tax return.

Read More: How the Foreign Earned Income Exclusion works.

5. Form 8833 – The Treaty-Based Return Position Disclosure

Are you using a Tax Treaty to avoid double taxation? If yes, then you’ll also need to file form 8833. This form is how you inform the IRS which tax treaty article you are using. At MyExpatTaxes, this is our profession, so if you don’t know which article (or articles) to claim, let us do the work. When you enter your information into the program, it will automatically help you select the right tax treaties for you.

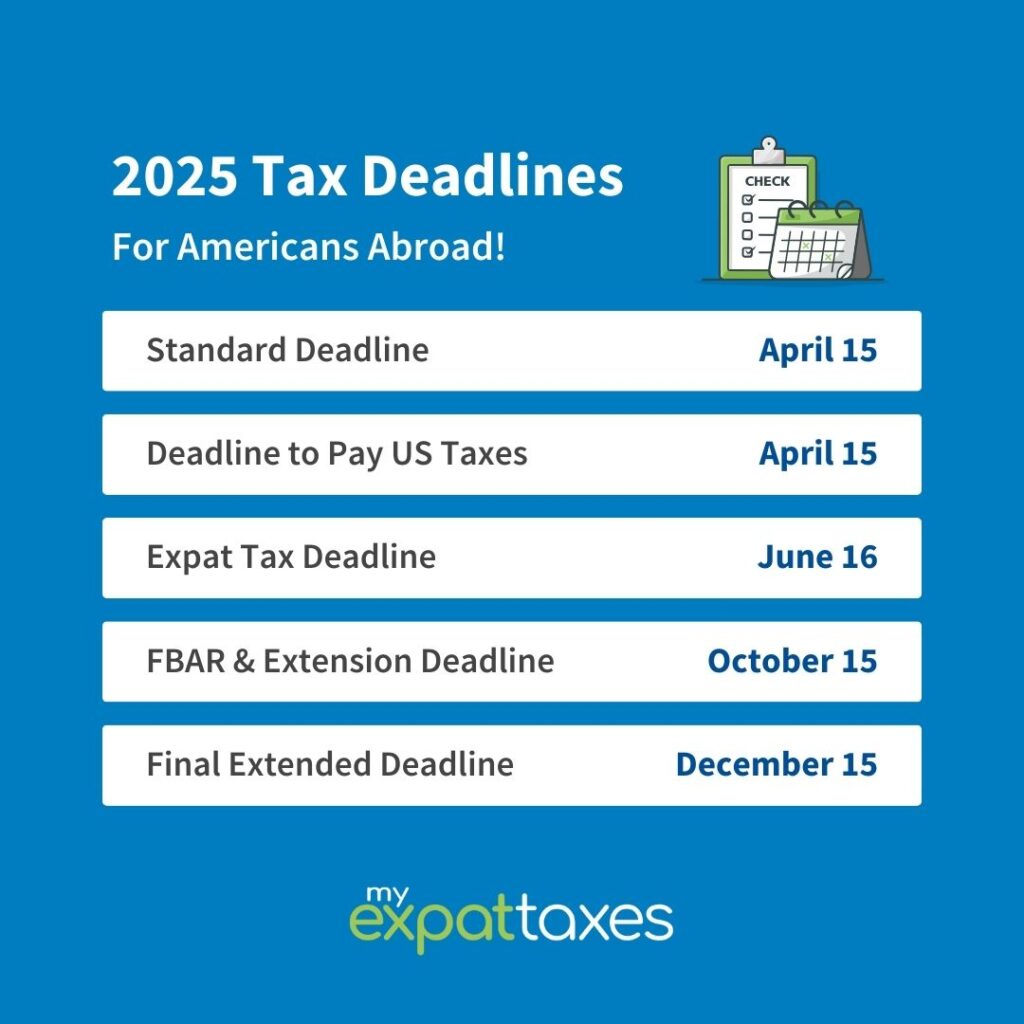

6. Form 4868 – The Automatic Extension Application

Use Form 4868 to claim your automatic extension. You can file electronically or via mail-in. If you live outside the United States, this extension will give you until October 15th to file your US taxes. An extension is a good option for people waiting for tax documents from other countries before they can finish their US return.

You’ll still need to pay any taxes you owe by the April 15th deadline. In addition, you’ll need to request your extension BEFORE the April 15th deadline. You can always file your tax return before the deadline, so request your extension early just to be safe! Request your expat tax extension for FREE.

Six MORE Tax Forms Expats Should Know

The six previously mentioned forms are the most important for expats to know because they will help keep Americans abroad tax-compliant and out of trouble with the IRS. However, there is still much more to know about US taxes, both at home and abroad. Keep reading to discover even more important tax forms that everyone should know.

1. 1040 – The US Individual Tax Return

Like most Americans and US expats, you’re probably already familiar with IRS Tax Form 1040. The 1040 is the standard tax form that every taxpayer must fill out each year.

In 2018, the 1040 was simplified in an attempt to make the US tax system more straightforward. Before 2018, taxpayers had to select the correct version of the 1040 based on their filing needs (1040, 1040-A, or 1040-EZ). Now, every taxpayer fills out the same 1040. Then, if they have additional income or taxes they need to report, taxpayers can attach Schedules 1, 2, and/or 3.

2. Schedules 1, 2, and 3

Schedules 1, 2, and 3 are supplements to your 1040. You’ll need to attach one or all of these forms if you have certain income types when you submit your tax return. I

- Schedule 1 – This is where you report Additional Income. Additional Income can be gambling winnings, alimony, stock options, unemployment, and more. Attach Schedule 1 to your 1040.

- Schedule 2 – Schedule 2 Covers Additional Taxes. These taxes include self-employment tax, taxes on IRA’s, Social Security on unreported income, and more. If you need to file Schedule 2, you’ll need to attach it to your 1040 when you file your Tax Return.

- Schedule 3 – IRS tax form Schedule 3 covers additional credits and payments. You’ll need to attach it to your 1040 if you have Foreign Tax Credits, Education Credits, credits for Child and Dependent Care Expenses, and more. Part I of Schedule 3 covers non-refundable credits. Anything listed here won’t get you a tax refund, but it could save you from paying in the end. Part II of Schedule 3 are refundable credits – at least in part. Make sure you’re paying careful attention here so that you get the highest tax refund possible.

3. Schedules A-E

Schedules A-E are more pages that you’ll possibly need to attach to your 1040.

- Schedule A – These are your itemized deductions. Deductions can include charitable donations, (US) State and local taxes you paid, and certain interest payments you’ve made.

- Schedule B– This is where you report your interest and dividends. Pay close attention to Part III here. It is where you need to report your Foreign Accounts and Trusts.

- Schedule C – Next up is schedule C. You’ll report your Business profits or losses here. For example, you’ll want to include your expenses and your overall Gross profit.

- Schedule D – This is the form where you report your Capital Gains and Losses. Part I covers your short-term gains or losses. These are usually assets that you held for less than one year. Part II is where you can report your long-term gains or losses. These will be mainly assets that you’ve held longer than a year. Part III is a summary of everything.

- Schedule E – Schedule E is where you will report any income you have from real estate rentals, partnerships, trusts, royalties, and more. There are several parts to this form. You’ll be reporting both your income and your expenses.

4. Schedule 8812 – The Additional Child Tax Credit.

Do you have kids? Are they considered qualifying dependents? Great! You can receive a refund via the Additional Child Tax Credit. The maximum amount you can receive is $1,400 per qualifying child, if you lived outside the US for more than half of 2021.

If you haven’t already received the full amount via the Advanced Child Tax Credit Payments, you can claim anything still owed as a refund. Maybe you already received more than $1,400 per qualifying child. You’ll have to pay back the IRS. Make sure you file your taxes And pay what you owe by April 18th. Doing so will make sure you don’t have to pay any penalties.

5. Schedule SE – Self-Employment Tax

Calling all self-employed expats! If you are self-employed, you need to make sure you attach Schedule SE to your 1040 if you cannot claim the Totalization Treaty Benefit available in your local country with the US. This is where you can report all of your self-employment earnings. It doesn’t matter if the earnings were from the US or outside the US; you’re still going to need to file Schedule SE.

Unfortunately, you cannot offset Self-Employment Tax with Foreign Tax Credits. However, the bright side is that it does help you contribute to your US Social Security benefits account.

6. State Tax Forms for Expats

Let’s not forget about our state tax obligations. Yes, even if you live abroad, you may have to pay state income taxes as well. Make sure you know whether or not your state will require you to file your taxes, and if you need to, make sure you de-register as a resident of that state. Some states are famous for making the process more difficult than others.

Work with the Expat Tax Professionals

If you’re starting to think you’d need to be a professional accountant to understand all of these forms, fear not! The goal of MyExpatTaxes is to make the US’s complicated taxation policies simple. Our software is created by expats for expats! We regularly work with Americans around the globe with complex tax returns.

If you need extra assistance, you can try out the Premium plan and have a MyExpatTaxes Tax Professional answer all your tax questions! Our Tax Professionals work exclusively with expats, making them highly experienced with all things tax treaties and Filing from abroad. You probably won’t find a better price either!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

September 24, 2024 | Paying Taxes, Tax Forms | 6 minute read