Most American Expats will receive a US Tax Refund for 2021, as well as other findings from MyExpatTaxes

August 19, 2022 | Press Releases |

Media & Press | MyExpatTaxes Press Releases

(Vienna, Austria) MyExpatTaxes are providers of expat tax software for Americans to file their US Taxes from outside the United States. This year, for the first time, MyExpatTaxes is releasing the analyzed data from their user’s 2021 US Expat Tax Returns.

The analysis will help MyExpatTaxes gain insight into how US taxes affect Americans living outside the United States. To conduct the study, MyExpatTaxes used anonymized data from users who have already completed their tax returns for the 2021 tax year.

The analysis includes user data of those who filed by the traditional tax filing deadline of April 18th, 2022, and users who filed before the automatically extended deadline for Americans abroad of June 15th, 2022. Users who requested an additional extension, giving them until October 15th, 2022, to file their 2021 US tax return from abroad, are omitted.

Included is data from over 4,500 expat tax returns.

MyExpatTaxes hopes the data can provide future insight into how US taxes affect Americans living outside the United States. MyExpatTaxes also uses the data internally to ensure users are maximizing their tax refunds.

Overall Results: US Expats

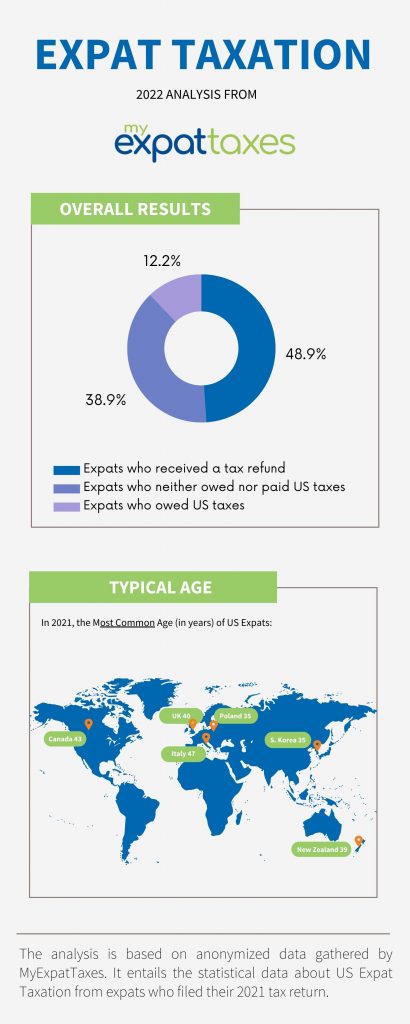

According to the data, most users who filed their 2021 tax returns with MyExpatTaxes will receive a tax refund. With 48.9% of users receiving a payment, just 12.2% of MyExpatTaxes users will need to make a payment to the IRS.

- 48.9% of Expat tax filers received a tax refund

- 38.9% neither owed nor paid US Taxes

- 12.2% owed US taxes

Source of Income for Expats:

Income sources for users of MyExpatTaxes are primarily via employment (53.3%) and Pension funds (12.4%).

- Employment – 53.3%

- Self-Employment – 12.4%

- Pension-18.5%

- Investment – 11.8%

- Rental Income – 4%

Most Common Age of Expats Filing Digitally with MyExpatTaxes

A look at the average age per country of residence reveals that most MyExpatTaxes users are between 35-45 years old.

- Singapore – 42 yrs

- Turkey – 44 yrs

- Hong Kong – 41 yrs

- Portugal – 46 yrs

- Ireland – 40 yrs

- Japan – 38 yrs

- Norway – 42 yrs

- Italy – 47 yrs

- UK – 40 yrs

- South Korea – 35 yrs

Countries where US expats are Most likely to receive a refund

The top three countries of residence for MyExpatTaxes users who qualify for a tax refund on their 2021 tax return:

- Finland – 70%

- Philippines: – 66.7%

- Indonesia: – 61.5%

Countries where American Expats are Most likely to owe US taxes

The top three countries of residence for MyExpatTaxes users who owed US taxes on their 2021 tax return:

- Singapore – 64.7%

- Thailand – 47.0%

- Turkey – 40.0%