Understanding US Taxes for Expats Living in Portugal

September 26, 2024 | Country Guides | 11 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated December 26, 2024

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated December 26, 2024

Welcome to amazing Portugal! From stunning palaces and lively cities to beautiful beaches and vineyards, life here is a mix of history, culture, and delicious food. If you’re a US expat soaking in the Portuguese lifestyle and living your best life, it’s important to understand your tax responsibilities in Portugal and the US. This guide is here to answer some of your questions. So, while you explore Lisbon’s charm, UNESCO Heritage Sites, and Algarve’s beaches, let’s simplify your tax journey. Making your stay in Portugal more enjoyable and relaxing!

US Expat Tax Benefits

If you’re a US expat, you’ll need to file US taxes even if you’re living in lovely Portugal. America is one of only two countries that requires their citizens living overseas to file taxes abroad. But don’t worry; as an expat, you are entitled to some tax advantages. Let’s get you up to speed with the essentials for an expat like yourself.

- Foreign Earned Income Exclusion (FEIE): The FEIE provision is designed to exclude a maximum of $126,500 of your foreign earned income from your taxable income.

- Foreign Tax Credit (FTC): The FTC provision permits you to credit the taxes you have paid in a foreign country against your US tax liability.

These tax benefits prevent double taxation. Other noteworthy advantages include foreign housing Exemption and tax treaties (which are limited to a certain number of countries).

Portuguese Tax Laws for Expats

The Non-Habitual Resident (NHR) Regime is an excellent opportunity for entrepreneurs looking to venture into Portugal’s dynamic market. Introduced in 2009 to attract high skilled professionals in specific fields, this tax regime offers a slew of benefits to qualifying individuals:

- Tax Exemptions: For a period of 10 years, NHR beneficiaries can enjoy tax exemptions on certain types of foreign-sourced income. This includes pensions, dividends, royalties, and interest from investments, promoting a favorable financial environment for expat entrepreneurs.

- Reduced Tax Rates: Certain types of Portuguese-sourced income, including self-employment and professional income from high-value-added activities, are subject to a special flat tax rate of 20%.

Portugal’s NHR regime facilitates an entrepreneur-friendly tax structure, enabling you to concentrate on scaling your business. It aids you in establishing your brand in a burgeoning European economy and thriving amid Portugal’s digital evolution.

So, for any self-employed expats looking to expand their business or even start their abroad – Portugal is where it’s at! It’s a great way to break the barrier in the European market!

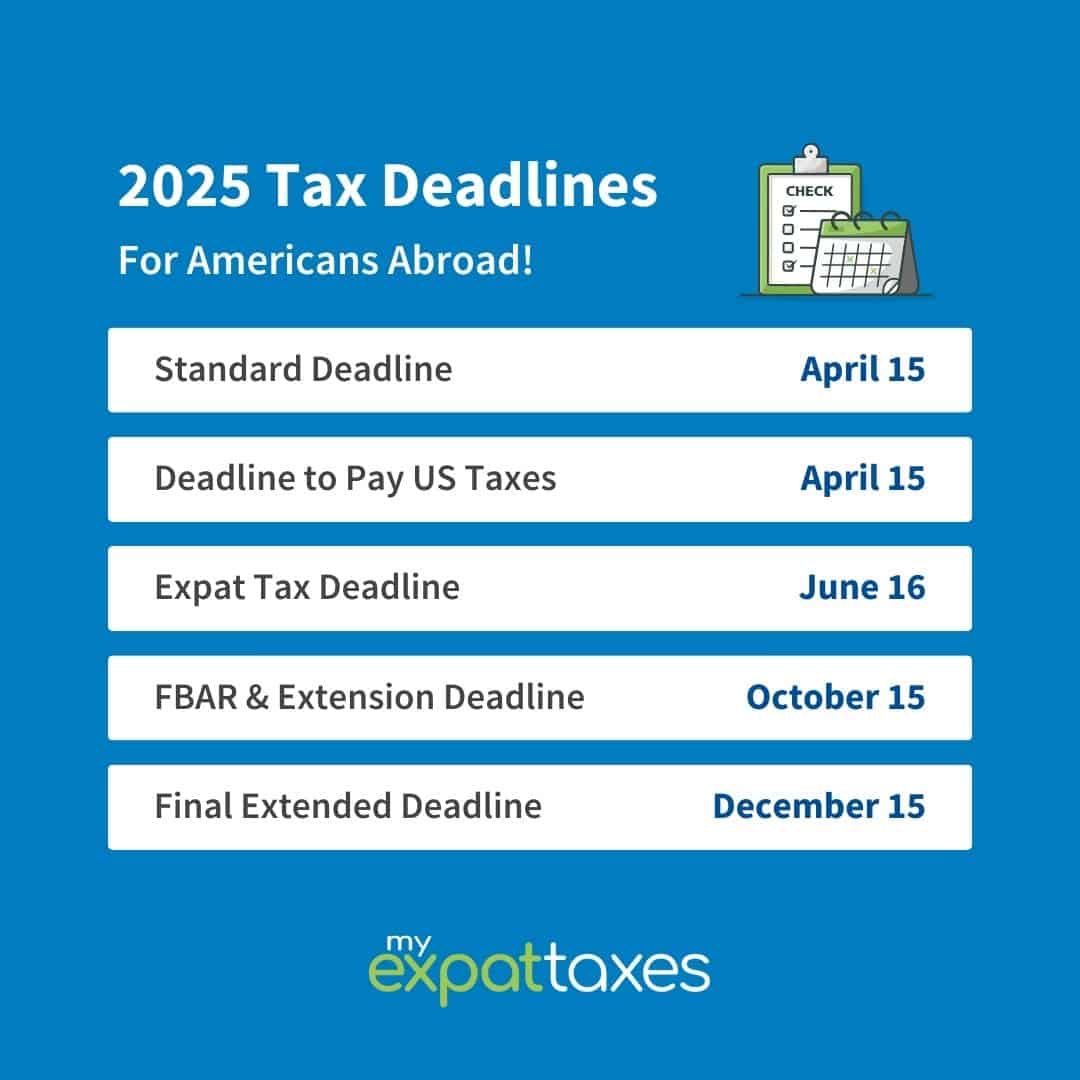

Expat Tax Deadlines

As an expat, you get the wonderful pleasure of knowing more than one important tax deadline. These deadlines actually generally offer you more time to file your US taxes. Except for when you need to pay taxes to the IRS then you have a strict deadline – April 15th. However, if you owe no taxes and are living and working abroad, you get an automatic 2-month extension, landing you to the June 15th deadline.

Some of the dates listed below are different from previous years due to the official dates landing on Holidays or weekends. For instance, in 2025, the June 15th deadline is moved to June 16th as it falls on a weekend.

Tax Dates for Portuguese Taxes

It shouldn’t come as a shock that different countries have different tax dates. However, as an expat living in Portugal, you’ll need to know not only the US tax dates but also the Portuguese tax dates. Luckily, there are not too many, and they line up nicely with the US deadlines.

- April 1st – June 30th: This is the period when all residents of Portugal, including expats, must file their annual Portuguese income tax return.

- August 31st: This is the payment deadline for any tax owed to the Portuguese tax authorities based on your filed tax return.

Filing US taxes with a Family

First, it would be good to identify if you even need to file your US taxes. This can be done by taking a look at where you fit into the tax threshold. Take a look at the chart below to see which category you fit into.

| Filing Status | Income Threshold |

|---|---|

| Single | $14,600 |

| Married Filing Jointly | $29,200 |

| Married Filing Separately | $5 |

| Head of Household | $21,900 |

| Qualifying Widow/er | $29,200 |

| Self-employed | $400 |

If you need more help determining which threshold you are, check out our tax guide about thresholds.

Child Tax Credits

Let’s talk children. Did you know that you can claim your Child Tax Credit (CTC) while living abroad? Yes, even as a US expat living and filing taxes in Portugal, you could still be eligible to get a little extra cash from the CTC. This credit helps to financially uplift parents or guardians of dependents and relieve some of the tax pressure on American parents.

But how do you qualify? Here’s a list we’ve put together.

- The dependent must be a minor under 17 years BEFORE December 30th, 2024

- They should be a US citizen, national, or resident alien

- You must claim the dependent on your tax return

- The child can be a son, daughter, stepchild, sibling, etc.

- The dependent must have lived with you for more than half of the tax year

- The dependent shouldn’t be financially self-supporting beyond half of their yearly expenses

- The child must have a valid Social Security number

Once these conditions are satisfied, the CTC can offer up to $2,000 per qualifying child and a refundable Additional Child Tax Credit (ACTC) of up to $1,700 per child. This means you can get a refund of $1,700 per child even if you owe no income tax. The nonrefundable portion of CTC reduces your tax liability, possibly to zero, but it does not bring any refund on its own.

To claim the CTC, you must file it with your federal income tax return. Depending on your income, you might need to fill out Schedule 8812, “Child Tax Credit,” of Form 1040 or 1040-SR.

Child & Dependent Care Credit

Taxes may feel annoying, but as a parent, you are the king/queen of the castle. You have the ability to claim not just one but two child-related credits. This credit helps to aid in costs related to care such as daycare, preschool, before—or after-school care, and even summer day camps. The qualifications for this credit are a little different from the CTC, but they are still worth it.

Key Aspects of the Child & Dependent Care Credit:

- Qualified Individuals: Dependents under 13 or those unable to care for themselves.

- Work Condition: The credit is accessible if care is necessary for you to work or seek employment.

- Credit Limits: A percentage of your expenses, between 20-35% depending on your adjusted gross income, with max qualifying expenses as $3,000 for one dependent or $6,000 for two or more.

- Dependent Assistance Programs: If your company offers a DCAP, it may offer notable tax savings.

- Claiming the Credit: Complete IRS Form 2441 and attach it to your Form 1040 or 1040A. You must include the details of your care provider.

US Expat Studying in Portugal

Ever thought about studying abroad? Well, from a tax perspective, it has some advantages. Not only do you benefit from learning the culture and the language, but also, you guessed it – tax benefits. Depending on individual circumstances and qualifying criteria, these benefits may include deductions or credits intended to help offset the cost of your education.

Tuition & Fees Deduction: This provision may allow you to deduct some portion of the tuition and other required fees paid for yourself, your spouse, or dependents to attend an eligible educational institution. It is important to note that this deduction is subject to income limits and is not available if your tax filing status is ‘married filing separately’ or if another person can claim you as a dependent on your tax return.

American Opportunity Tax Credit (AOTC): The AOTC caters to undergraduate students who are enrolled at least half-time in a program leading to a degree, certificate, or other recognized educational credential. It offers a credit for up to $2,500 of qualified education expenses, where 40% of the credit (up to $1,000) is refundable.

Lifetime Learning Credit (LLC): Unlike the AOTC, the LLC is not restricted to undergraduate students or a specific number of years. It offers a non-refundable credit of up to $2,000 per tax return for qualified education expenses. Although it has income restrictions, its broad eligibility requirements make it potentially applicable for post-secondary education, courses to acquire or improve job skills, and tuition for non-academic hobbies and sports.

Catching up on US taxes

You could be wondering what happens if you didn’t know that filing US taxes abroad was necessary. It’s not uncommon for US citizens to be unaware of their tax obligations when living abroad. This could be for a whole range of reasons, from just not knowing to being born an Accidental American. However, the IRS noticed this common mistake and created a procedure known as the Streamlined Procedure. This procedure is used to help US citizens catch up on three years of tax returns and six years of FBARs. Overall, the Streamlined Procedure is a real chance for US expats to become tax-compliant once again.

NOTE: The Streamlined Procedure is only helpful if the IRS hasn’t found you already!

Now, if the IRS did find out about your mistake, you will not qualify for the Streamlined Procedure, BUT that does not mean you have a huge amount of taxes to pay to the IRS, so take a breath. There is another way, this way is known as the First-Time Abatement Program. As always, there are criteria you need to met, which you can read about on the IRS website dedicated to explaining the First-Time Abatement Program.

Self-employment in Portugal

You’re a self-employed US expat living and working in Portugal; we’re so proud of you and your achievements! Although it would be nice to skip this part about taxes because taxes suck, yet it’s obligatory and unavoidable. It has to get done, but as MyExpatTaxes is a tax company specializing in expat taxes, we have a few details you should know.

- Filing a US tax return becomes necessary when your self-employment income reaches $400 or more annually.

- If you earn self-employment income, the US government may require you to pay 15.3% of your net profit as Self-Employment taxes.

- Fortunately, Portugal and the US have a totalization agreement. This agreement allows you to use the treaty to offset US Self-Employment taxes.

This is just a fair warning to anyone filing self-employment taxes: You have to make sure not to use US-based tax software because it usually leads to you being charged the WRONG self-employment tax. Fortunately, you find yourself in the right place. Our CEO is a US expat, meaning MyExpatTaxes software is specialized for people just like you.

Investing in Real Estate in Portugal

Investing in real estate in Portugal is more than just dreaming of a beautiful European lifestyle—it’s a smart move for several reasons. Let us explain a few reasons why:

Golden Visa Program: Portugal offers a Golden Visa program, which allows investors, including real estate investors, to obtain residency by making qualifying investments. This can be particularly attractive for those seeking a second residency in Europe.

Stable Real Estate Market: Portugal has experienced a stable real estate market with consistent growth, especially in popular tourist destinations. This stability can provide a secure investment environment.

Diverse Property Options: Portugal offers a diverse range of property options, from historic city apartments to coastal villas and countryside estates. This diversity allows investors to choose properties that align with their preferences and investment goals.

Tax Incentives: While there are property taxes, Portugal offers certain tax incentives, exemptions, and reductions, especially for properties in urban rehabilitation areas. This can make real estate investment more tax-efficient.

Get Started with MyExpatTaxes

Navigating tax laws as a US expat can be overwhelming. However, our team makes it easy and transparent with our software made by expats for expats. We’re here to make taxes a breeze and to help limit your stress when April comes around. So, in that case, enjoy living as an expat in Portugal and leave the unnecessary hassle of doing US taxes to your friends at MyExpatTaxes.

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

September 26, 2024 | Country Guides | 11 minute read