A Guide to Filing US Expat Taxes from Colombia

November 15, 2024 | Country Guides | 8 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated January 20, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated January 20, 2025

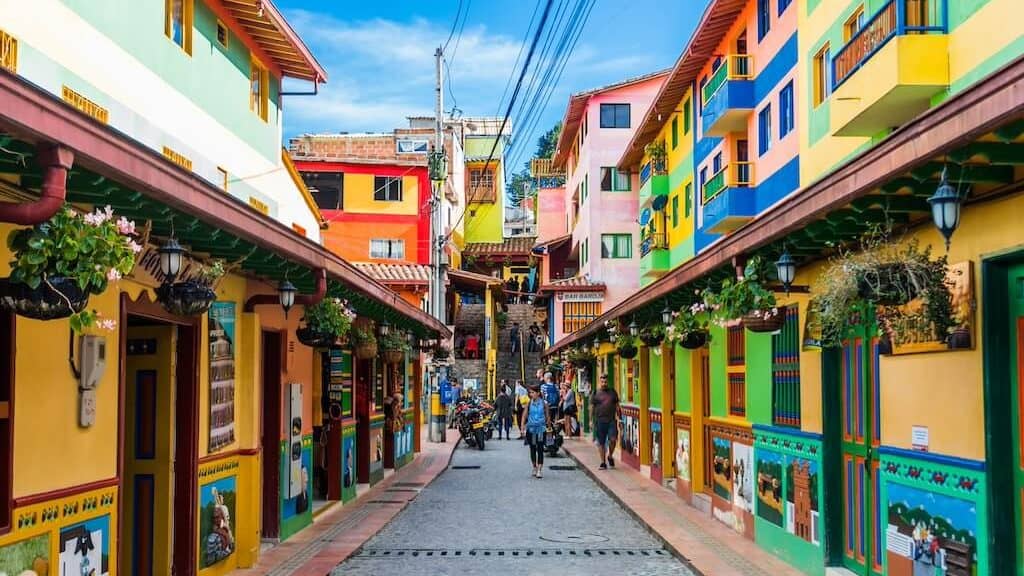

Colombia is a country of diverse landscapes, from the Amazon rainforest to deserts. It is a beautiful country located in South America, a bridge between Brazil, Venezuela, Ecuador, and Peru. It’s no wonder you fell in love with Colombia. However, you cannot forget the responsibilities that come with being a US citizen. From filing US taxes in Colombia to buying property in Colombia—this guide is made just for you!

Do you need to file US taxes?

Welcome to the part of the blog where you become aware of your tax duties as a US citizen or Green Card holder, regardless of where you’re living. When you have ties to the US, this responsibility is likely unavoidable. However, there are many opportunities for you to owe little to nothing or even receive some extra cash! See, it’s not so bad! But first, let’s get the less awesome information out of the way.

US Tax Forms

Let’s take Form 1040, which is your income tax return. Within this form, there are many schedules and parts that need to be filled out just based on which type of income you’re earning. Form 1040 is the most important form you’ll have to file. However, there is a way of getting out of filing US taxes – you’ll need to be under the threshold amount.

Here’s a small overview for someone under the age of 65

- Single $14,600

- Married filing separately $5

- Head of Household $21,900

*If you do not fit into any of the above-mentioned categories, you’ll need to visit our US expat tax basics guide to see all the options.

FBAR

The second most common form for you as a US expat or Green Card holder is the FBAR (Foreign Bank Account Report) or Form 116. This report is just as essential to any form you’ll file with your income taxes. Fun fact about the FBAR is that it’s just as mandatory as Form 1040, but you do not send this form to the IRS. Ensure this gets sent to FinCEN, the Foreign Crimes Enforcement Network.

Like many forms, you’ll need to reach a certain amount annually for it to become an added responsibility. You much have collectively had $10,000 in your foreign bank accounts at any point in the last year. Otherwise, you do not need to report your foreign bank accounts!

Additional Forms to Note

- Form 2555: Foreign Earned Income Exclusion

- Form 1116: Foreign Tax Credit

- Form 8938: Statement of Specified Foreign Financial Assets

- Form 8621: Passive Foreign Investment Company

Tax Benefits for US Expat in Colombia

No Colombia-US Tax Treaty

While Colombia has several tax treaties with other countries in the world, the US is not one of them. The consequence of this is that US citizens living and working in Colombia are subject to normal tax rates (as they do not get lower rates from a tax treaty) and are at higher risk of double taxation. However, with that being said, there are options out there for US citizens to avoid double taxation.

Foreign Earned Income Exclusion (FEIE)

When you go to file US taxes in Colombia, claiming your foreign earned income exclusion can make it so you owe little or no taxes to the US. As a US citizen, it is still required to file, but this little nifty trick makes the process a little less stressful!

Here’s how you can ensure you qualify:

It starts with seeing which one of these tests best matches your life.

The Bona Fide Residency Test has more to do with what ties you have within Colombia. For instance, is your family, permanent housing, primary job and so on in a foreign country.

The Physical Presence Test counts the physical days on which you have been in Colombia or any other foreign country.

Foreign Tax Credit (FTC)

You can claim more benefits, especially if you cannot claim the FEIE or have exceeded the threshold! However, claiming the FTC requires a lot of calculations, which is why it’s recommended that you leave it to a Tax Professional.

The FTC allows you to manually calculate everything that you have paid in Colombian taxes and convert it into a US tax deductible for US taxes owed.

Keep in mind that without a valid tax treaty in place, you can only claim foreign taxes on foreign income. Therefore, US-sourced income, such as salaries earned from a Colombian employer while working out of the US, which is sourced based on where you worked when you earned the income, can be double taxed in both Columbia and the US.

Child Tax Credit (CTC)

As a US citizen, you can even claim benefits for your family. Like every credit or benefit, you need to be eligible for it. With that being said, take a look at the basic requirements and see if you think your family will qualify.

- Your child must be under the age of 17 before the end of the tax year.

- Your child must live with you for half or more of the tax year

- Your child must have a valid Social Security number (SSN)

If you know you’re likely to qualify, you’re probably wondering how much money you can receive. Well, if you do not owe US taxes, you can receive $1,700 refundable credit for every child. However, if you do owe the IRS, you can deduct up to $2,000 from your tax return for every qualifying child.

Filing Deadlines and Extensions

Knowing when to file is just as important as knowing what you need to file. Therefore, you need to be aware of the deadlines and extensions as a US expat (because they’re a bit different when you’re an expat). There are two categories for deadlines: income tax deadlines and the others are FBAR deadlines.

US Tax Deadlines for Expats

- April 15: This is the deadline for anyone who owes US taxes

- June 15: Automatic 2-month extension for US expats

- October 15: Extension if you cannot file by the June deadline

- December 15: Last extension possibility

FBAR deadlines

- April 15: The deadline for filing your FBAR

- October 15: Automatic extension

Becoming Tax-Compliant Once Again

Say you’ve been living in Colombia for the last ten years, but your US taxes were left behind (as in unfiled). The IRS introduced a procedure known as the Streamlined Procedure, which allows you to become tax-compliant without the additional stress of penalties. Fear not; you also do not need to file ten years of prior tax returns and FBARs. In fact, you will only need to file three plus the current year and up to six FBARs.

Residency Status in Colombia

Residency for tax purposes in Colombia is split into two seconds: fiscal residents and non-residents. Determining if you’re a non-resident or a fiscal resident can be done with the 183-day rule. The 183-day rule in Colombia states that if you have collectively stayed in the country for more than 183 of 365 days of the year, then you are a fiscal resident.

However, even if you’re considered a non-resident, your Colombian-sourced income will be subject to taxation and must be reported on a Colombian tax return. If you’re a fiscal resident, all worldwide income can be taxed and must be reported.

Filing Colombian Taxes

As a US expat living in Colombia, you know US taxes are not the only taxes that you need to file. You cannot forget about Colombian taxes as well!

Like many countries, there is no fixed income tax rate; your income will determine how much taxes you owe to the Colombian government. Depending on how many Colombian pesos you earn, you will be put in a tax bracket starting from 0% to 39%. If you’re earning more than 31,000 Colombian pesos (equaling around $74 in 2024), you will be put into the highest income bracket.

Tax Deadline in Colombia

When it comes to filing Colombian taxes, it’ll be quite difficult to determine your tax deadline without the last two digits of your tax ID number. In general, the deadline usually starts in August somewhere, but it is published in December every year.

Renting vs Buying Property in Colombia

Renting Property

If you’re looking to rent in Colombia, you’re in luck because you can skip the deposit as it’s actually illegal in Colombia. However, if there is a lack of credit in the country, you will likely need a guarantor to ensure the rent is paid or payment in advance. Also, say goodbye to long-term rental contracts because these contracts go by months, generally from 6 months to 1 year.

Looking for an apartment in Colombia can be intimidating, especially because of the language barrier. If you’re not fluent in Spanish, it is highly recommended that you get a translator or consult a lawyer when you’re going through this process.

Some other major points before renting your apartment: Your termination of the contract will need to be openly discussed, as it automatically renews. If you plan to leave, give three months’ notice, or you will be subject to penalties!

*Under one-month contracts are illegal

Buying Property

If you’re looking for something more permanent in Colombia, buying property could be your future! From what you’re used to in the US with regard to property pricing, Colombia has some very attractive deals on houses. Plus, you have nearly the same rights as any Colombian citizen when it comes to purchasing property.

Before you go purchasing anything, make sure to get a local real estate agent familiar with the market. It will make the search and purchasing process a little less stressful. When you find the home of your dreams, signing a document called the ‘promesa de compraventa‘ will ensure your negotiated price is permanent. After determining a price, use a third-party service for the transferring of your funds to make sure your payments are secure and safe.

Like purchasing any property, you will have other expenses such as transfer taxes (specific to Colombia at 2-3% of the purchasing price), notary fees, and legal fees.

*Please not that just because you purchase property in Colombia, does not mean you can live there permanently, although, it could help you to get a resident visa or migrant visa.

Practical Tips for Managing US Taxes in Colombia

Knowing where to start when it comes to filing your US taxes in Colombia can be overwhelming. Therefore, from MyExpatTaxes to you, here is everything we would recommend.

- Keep accurate records of your finances: Tax Professionals will still need these documents to help you file

- Use a tax software that specializes in US expats: many standard tax companies forget important forms like Form 2555, Form 1116, or even the FBAR

- Staying informed about tax law changes: new laws and procedures could impact your US taxes

BONUS: Set reminders on your cellphone or follow a tax company like MyExpatTaxes on LinkedIn, Facebook, TikTok, or Instagram, so you do not forget the deadlines!

Additional Questions About Expat Taxes?

Are you seeking guidance on filing US expat taxes from Colombia? Our team of knowledgeable tax experts is here to assist you every step of the way. Helping ensure compliance with US tax requirements while you’re living abroad.

Don’t miss your annual US tax filing. Trust MyExpatTaxes, the leading expat tax software for Americans overseas. Get started today with a free account!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

November 15, 2024 | Country Guides | 8 minute read