Your Guide to Expat Taxes for Americans in Switzerland

September 12, 2024 | Country Guides | 6 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated December 27, 2024

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated December 27, 2024

You’ve moved abroad to the picturesque landscapes of Switzerland! You’re experiencing the captivating Alps, indulging in Swiss chocolate, and are busy exploring your new home country. Switzerland is a dream come true for US expats! However, you can’t forget your US citizen or Green Card holder responsibilities. Let’s get you up to speed with everything you’ll need to know about filing your US taxes from Switzerland.

Topics Overview

Determining Your Filing Status and Tax Benefits

You could have a different filing status depending on your relationship status or your role in your household. If you’re married to a foreigner, you likely do not want to subject your partner to US taxes. In this case, you would file as ‘Married Filing Separately’. If your spouse has US citizenship or a Green Card, you could benefit from filing as ‘Married Filing Jointly’.

If you’re married, filing jointly, or a single filer with a family of your own, you could be eligible for the Child Tax Credit (CTC). The CTC allows you to claim up to $2,000 per qualifying child. Additionally, if you do not owe US taxes, you could get up to $1,700 could be refunded.

Filing Requirements for US Expats in Switzerland

Even from Switzerland, if you are a US citizen or Green Card holder, you must file US taxes annually. When you have ties to the US, the IRS expects you to report global income even when you have lived abroad for many years.

Important Fact: If you have a Green Card, you must remember to renounce it legally, or you will still be subject to filing US taxes.

For those under the filing thresholds, you will not need to file a US tax return. There are six options for this, all with different amounts: Single, Married Filing Separately, Married Filing Jointly, Widowed, Head of Household, and Self-Employed.

In 2025, if you are a single filer and earn more than $14,600, you will have to file US taxes. It’s the same if you earn $29,200. and are married, filing jointly, or $5 filing separately.

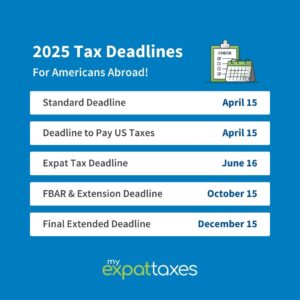

Key Deadlines

Deadlines can change depending on whether they fall on a holiday or a weekend. For instance, in 2025, the June 15th deadline fell on a weekend, moving it to June 16th.

You needed to file your Swiss taxes by March 31st, if your income tax rate was over 15,000 CHF as a single filer. If you’re living in certain cities, you will also need to file cantonal taxes. Since the Swiss deadline has come and gone, it’s a good time to focus on the October 15th deadline if you haven’t filed your US taxes.

Catching Up on Past Returns

For US citizens in Switzerland who did not realize their filing duties, you may be eligible for the IRS amnesty program called The Streamlined Procedure. This procedure allows you to file three years of past returns and six years of FBARS, free of penalties. Note that this option is only available to those who have not been contacted by the IRS about their missing returns.

Important Tax Forms for US Expats

When you are filing US taxes as an expat, there are several forms that can help prevent double taxation. These forms include Form 1116, Form 2555, Form 8938, and Form 114.

| Foreign Tax Credit (FTC) or Form 1116 is a tax credit that allows you to reduce your US taxation with the Swiss taxes you’ve already paid. |

| Form 2555 is known as Foreign Earned Income Exclusion (FEIE), and it allows you to exclude up to $126,500 of foreign earned income from your US taxes. |

| FATCA or Form 8938, requires you to report foreign assets over certain thresholds. |

| Form 114, or FBAR, requires you to report any foreign financial accounts exceeding $10,000. |

Self-Employment in Switzerland

You’re self-employed in Switzerland, that’s impressive! As a US citizen, you will also have to remember your US self-employment taxes. The self-employment filing threshold is $400. Since you have completed your work in Switzerland, even if you have clients based in the US, you must file if you exceed this threshold. If you know you will need to file in 2025, try to set aside 15.3% of your income for tax purposes.

Check out our upcoming webinars to learn more about US taxes as an American expat!

Buying Property in Switzerland

Switzerland has so much to provide to residences: stunning landscapes, a high quality of life, and economic stability. Since Switzerland is a hotspot for tourists and expats alike, there are restrictions on who can purchase property in the country. As a foreigner, it may be very difficult to purchase property if you do not have a Swiss Residency Permit. Although it is not impossible to purchase property as a foreigner without a permit, you will be restricted to 200 square meters.

Renting Property in Switzerland

Not ready to put down permanent roots just yet? Renting is a great option for expats in Switzerland. Not only can renting help save some extra money, but it allows you the freedom to decide where to go next.

Renting in Switzerland is a popular option among US expats. It’s a beautiful place, but it does have high property costs. The rental market is competitive, especially in cities like Zürich, with leases typically requiring a three-month deposit.

If you are a landlord in Switzerland, remember that rental income must be reported to both Swiss and US tax authorities. US expats can deduct expenses like mortgage interest and repairs on their US tax returns.

Non-residents face higher down payments (20-40%) for buying property, and legal fees add up to 1%. Property ownership may impact residency status and involve ongoing property taxes in both countries.

Investing from Switzerland

As an American living in Switzerland looking to invest, knowing the strict guidelines imposed on expats can save you time and money. When you’re beginning, some investment options are more recommended than others.

Depending on what type of investing you’re looking to do, it’s safe to say any investment into your future is beneficial. With IRAs or Roth IRAs, you can start contributing up to $7,000 per year into a retirement account. If you’re looking for something that could earn you money in the next few years, US-based stocks and bonds could be the answer.

Have you already invested your money in Switzerland or other foreign mutual funds? You might need to file a PFIC, but don’t worry—MyExpatTaxes can help you.

Retiring in Switzerland

Retiring to Switzerland is a dream, especially regarding quality of life. Even when you’re not living in the US, you can still receive US Social Security payments, generally free of Swiss taxes. If you receive a Swiss pension, you could benefit from tax deferrals as there is a US-Switzerland Tax Treaty. Yet, you still report any Swiss pension income on your US taxes to offset your liabilities.

Seeking Professional Assistance

US expat taxes in Switzerland can be confusing, but when you seek professional assistance from MyExpatTaxes rest assured our software is tailored to expats. Making it quick and easy to file your US taxes from abroad. With the October 15th deadline approaching, sign up and start filing today!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

September 12, 2024 | Country Guides | 6 minute read