Filing US Taxes from New Zealand as an Expat

October 30, 2024 | Country Guides | 5 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated December 23, 2024

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated December 23, 2024

New Zealand is a country with breathtaking ocean views, stunning landscapes, and a rich Māori culture. From Auckland to Christchurch, the high quality of life captivates fellow expats like yourself. With the beauty of a country like New Zealand, it’s understandable why you’re a little preoccupied, but let’s not forget our responsibilities as US citizens. This blog will update you on some basics for filing US expat taxes from New Zealand.

Table of Content

- Who Needs to File US Taxes?

- New Zealand Tax Residents

- Income Taxes in New Zealand

- Visas Options for US Citizens in New Zealand

- Tax Deadlines: US vs. New Zealand

- US Tax Benefits for Expats

- Family Tax Benefits from New Zealand

- Self-Employment in New Zealand

- Retiring in New Zealand

- First-Time Filing After Moving Abroad

- Getting Professional Help

Who Needs to File US Taxes While Living in New Zealand?

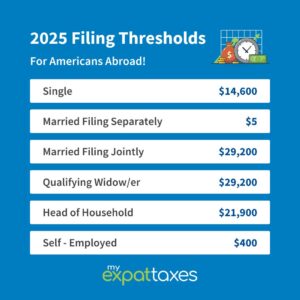

Two critical areas will determine whether you will be filing US taxes from New Zealand. First, if you are a US citizen or Green Card holder, you will likely have to file, but only if your income exceeds a certain threshold.

Residency Status and New Zealand Tax for Expats

When filing New Zealand taxes, you must determine your residency, often using the 183-day rule. The 183-day rule means you are considered a resident of New Zealand if you have spent 183 days or more in New Zealand in any 12 months.

If you are a non-resident, your New Zealand-earned income will likely still be subject to local taxation.

Income Tax Rates for New Zealand

| Taxable Income (NZD) | Tax Rate |

|---|---|

| Under 15,600 | 10.5% |

| 15,601-53,500 | 17.5% |

| 53,501-78,100 | 30% |

| 78,101-180,000 | 33% |

| 180,001 and above | 39% |

Source: New Zealand Government

Work Visa Options for US Expats in New Zealand

New Zealand offers many visa options for a US expat, but each comes with its own tax obligations. Here are a few of the most common options for working expats.

Skilled Migrant Visa: If you are a skilled worker, you may qualify for this New Zealand visa. If granted this visa, you will be considered a resident with a 6-12 month visa to stay. The skilled migrant’s visa will require you to pay taxes on your worldwide income and could affect your US tax filing.

Work to Residence Visa: You must have a job from an accredited employer. Just like the skilled migrant visa, you will be considered a tax resident, meaning you will have to pay taxes on your worldwide income.

Working Holiday Visa: With this visa, you can work and live in New Zealand for 12 months, but this does not automatically make you a tax resident. If you stay more than 183 days, you will be considered a tax resident.

These visas only account for a fraction of the options available to US expats. Choose wisely, as your tax residency will affect your tax liability to the US and New Zealand.

Comparing Key Tax Deadlines for US Expats

There is no universal deadline for filing taxes; each country has its own deadlines. You have a completely different calendar year and filing deadline for New Zealand from the US. Help yourself stay organized by setting reminders for the deadlines below.

| Country | Tax Year | Filing Deadline | Extended Deadline |

|---|---|---|---|

| United States | January 1st – December 31st | April 15th (June 15th for expats) | October 15th |

| New Zealand | April 1st – March 31st | July 7th | No formal extension is available* |

For US taxes, know that the deadlines are subject to change by a few days if they fall on a weekend or holiday. Additionally, if you owe US taxes, you must pay by April 15th. Otherwise, you will likely face penalties.

Get your email reminders about upcoming deadlines!

US Tax Benefits for Expats in New Zealand

US expats should know these three main tax benefits when living in New Zealand. These benefits will help limit double taxation.

- Foreign Tax Credit (FTC): Reduces US tax liability by allowing you to claim a credit for income taxes paid in New Zealand.

- Foreign Earned Income Exclusion (FEIE): Allows qualifying expats to exclude up to $126,500 of foreign earned income from the taxes they owe to the US.

- US-New Zealand Tax Treaty Benefits: Provides relief on certain income types to prevent double taxation.

Filing US taxes from New Zealand involves many elements, but if you know these three benefits, you are well on your way to avoiding double taxation!

Family Tax Benefits for US Expats in New Zealand

You can claim family tax credits when you move abroad as a US citizen. One is known as the Child Tax Credit (CTC). With this credit, you could reduce your tax liability by up to $2,000 per child under 17 with a Social Security Number. If you’re lucky and do not owe US taxes, you could receive up to $1,700 as a refundable credit.

Although, to receive the full $1,700, your income must be under a certain amount. You will not receive the full refund if your income is over $200,000 as a single filer or over $400,000 as a joint filer.

Self-Employment Taxes for US Expats

If you’re a US entrepreneur in New Zealand, and you are earning more than $400, you will need to contribute 15.3% of your income to US self-employment taxes.

Self-employment taxes in New Zealand depend on your income bracket, but as soon as your annual turnover reaches over 60,000 NZD, you will be subject to 15% of goods and services taxes.

Yes, as there is no totalization treaty between the US and New Zealand, you are subject to Social Security taxes on self-employment income in both countries. Therefore, it’s crucial to plan accordingly.

Retiring and Filing from New Zealand

Retirement in New Zealand has come with nice perks. Before you decide to retire there, you should decide how you want to invest in your retirement savings. For US expats, it’s best to consider IRAs and 401(k)s because they are not as heavily taxed by the US. However, it’s important to consult a local tax consultant as well to determine how these US funds are taxed in New Zealand.

You could also look into the KiwiSaver in New Zealand. KiwiSaver is a voluntary savings program that is deducted from your salary. Employers also match your contributions to a certain percentage. Generally, Kiwisavers will be exempt from US Foreign Trust reporting; however, it’s best to check in advance.

If you need help understanding how your US and local retirement funds are taxed on your US tax return, remember to use our MyExpatPlanning options.

First-Time Filers of US Taxes from New Zealand

If you didn’t know you should be filing US taxes after moving to New Zealand, you’re not the only one. The IRS introduced the Streamlined Procedure so US expats unaware of their overseas filing could catch up without penalties. This procedure allows you to file the last three tax returns and up to six foreign bank account reports (FBAR). To qualify, the IRS must not have contacted you, or you will automatically be disqualified from using this procedure.

Next Steps for US Expats in New Zealand

Filing US taxes from New Zealand takes careful planning, but services specializing in US expat taxes can relax your filing experience. If you want to ensure your taxes are filed with the utmost precision, file with the people at MyExpatTaxes!

If you need help with what to do or where to go, it’s always best to consult a professional at MyExpatTaxes.

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

October 30, 2024 | Country Guides | 5 minute read