Form 2441: Child and Dependent Care Credit for US Expats

March 5, 2025 | Family Tax Support, Tax Forms | 3 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated October 6, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated October 6, 2025

The cost of childcare can be exorbitant, even outside of the US. If you are a US expat parent paying for childcare while living abroad, then it is time to familiarize yourself with Form 2441: Child and Dependent Care Credit!

What is Form 2441: Child and Dependent Care Credit?

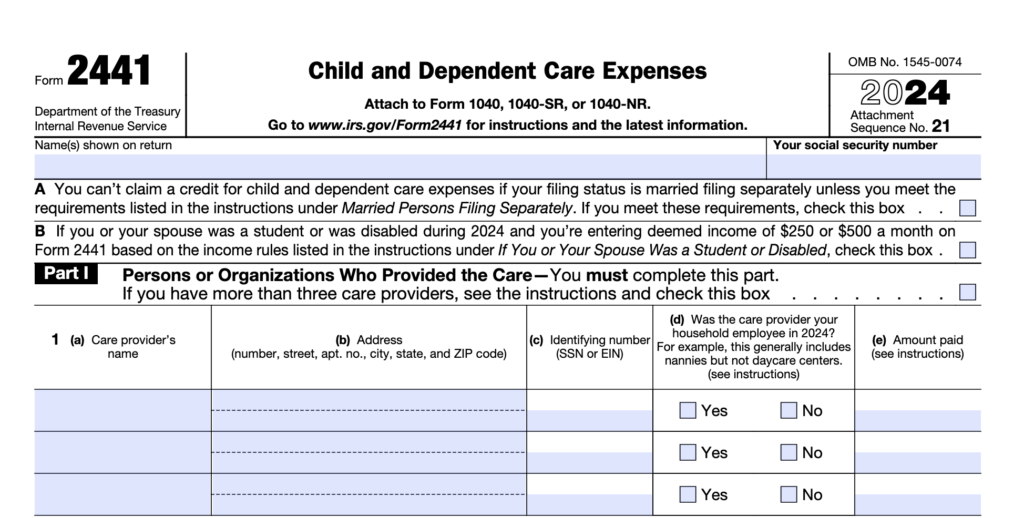

Form 2441 is an IRS form used to report child or dependent care expenses on your US expat tax return. Using this form, you can claim a tax credit for costs paid to a caregiver or care facility that looked after your child or qualifying dependent while you worked or searched for work.

It is important to note that completing the form does not guarantee that you or your dependents are eligible for this non-refundable tax credit, as there are limitations that we will explore later.

The credit is capped at 35% of your employment-related expenses; however, most folks won’t be able to claim even that much. It will decrease to only 20% if you have an adjusted gross income of $43,000 or more for Tax Year 2024.

Who is Eligible to Claim Form 2441

There are strict guidelines for who can claim the Child and Dependent Care Credit.

Eligible care expenses cover payments for:

- Household Services: Paying someone to care for a dependent in your home

- Care Center Usage: Such as a daycare

Further requirements include:

- The child or qualifying dependent must be aged 13 or younger

- Suppose there are physical or mental disabilities, and the dependent is incapable of caring for themselves. In that case, they may be considered a qualified individual at any age if you claim them as a dependent on your tax return.

- The care payments were paid so that you could work or search for work.

- You must have earned income on your US expat tax return. For those filing jointly, you and your spouse must be full-time students or have earned income.

- Earned income is any income you receive, such as salaries, wages, or net profits from self-employment.

- If your entire income is excluded by using the FEIE, you cannot claim the Child Care Credit!

- You cannot claim this credit if you file as “married filing separately.”

- The child or dependent has to have lived with you for over half of the year.

Form 2441 FAQ:

Which Information Must be Provided

- Personal Details: Your name, Social Security number, as well as the name and Social Security numbers of dependents being claimed

- Care Provider Information: Caregiver or facility name, address, and TIN or Social Security number

- If your child received care in a foreign country, then you can substitute the US tax identification number with “LAFCP” (Living Abroad, Foreign Child Care Provider)

- Care Expenses: The total amount of care expenses during the tax year

- Earned Income: Your earned income or, if filing jointly with a spouse, the earned income of your spouse

- Claimed Credit: The amount of child care tax credit you are claiming based on the expenses provided

Will the IRS Verify Childcare Expenses?

US expats must be prepared to show proof of childcare expenses, including the care costs paid.

What Counts as Qualified Expenses on Form 2441?

Qualified expenses cover payments for household services or using a daycare center to care for the qualifying dependent while you work or search for work. Household services may include a babysitter, housekeeper, or cleaning service if they care for the dependent.

Can Form 2441 be E-filed?

Form 2441 can be e-filed with MyExpatTaxes alongside your federal US expat tax return. Our software will assist you in maximizing Form 2441 to ensure you receive the highest refund possible.

Let MyExpatTaxes Help!

MyExpatTaxes was created by expats, for expats. CEO Nathalie Goldstein, an expat parent herself, designed our software to help parents and caregivers maximize their tax refunds, regardless of their location. Start today and ensure you’re receiving the full benefits you deserve.

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

March 5, 2025 | Family Tax Support, Tax Forms | 3 minute read