What is Form 8938?

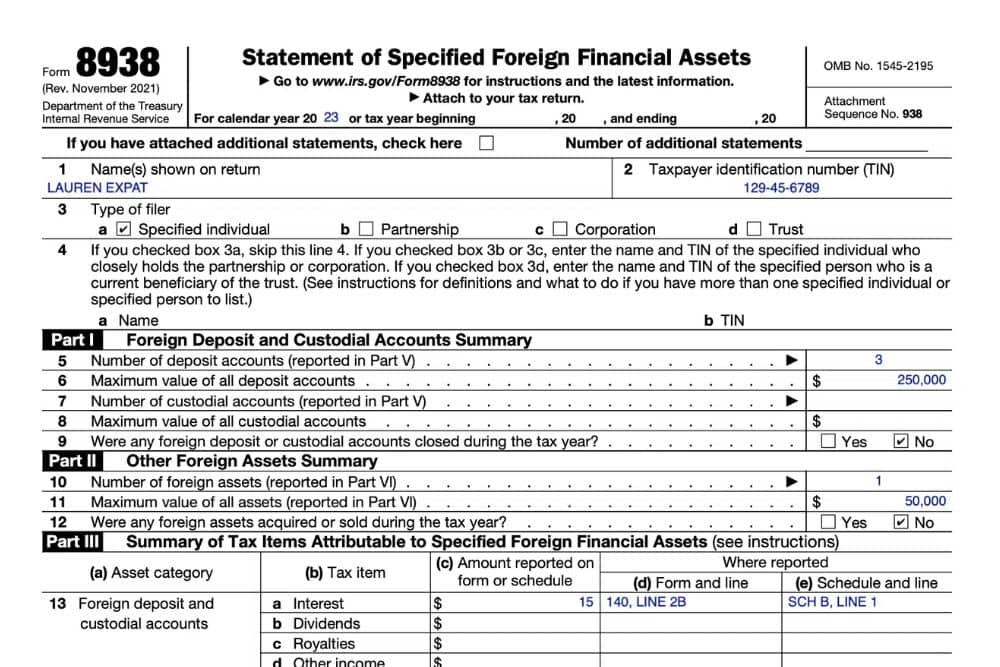

IRS Form 8938, the Statement of Specified Foreign Financial Assets, is crucial for US taxpayers with financial interests in foreign assets. The Foreign Account Tax Compliance Act (FATCA) ensures that US taxpayers disclose their foreign financial holdings to the IRS to combat offshore tax evasion. As global financial ties become more common, it’s increasingly important for US expats with foreign investments to understand when and how to file this form. Failure to do so can result in significant penalties, making it essential for those with qualifying assets to stay compliant with tax regulations.

This article will detail who needs to file Form 8938, which foreign assets to report, and the consequences of non-compliance.

Who must file Form 8938?

If you’re a US citizen or a resident alien (Green Card holder) living outside the US, you must file Form 8938 with your annual US tax return if you meet specific asset thresholds. You must use the form to report foreign financial assets you hold, including bank accounts, investment accounts, pensions, and other specified assets.

Income and Filing Status Thresholds for Expats

The filing requirement is based on your filing status and the total value of your specified foreign assets. The thresholds for expats are higher than those living in the US, acknowledging the different financial situations of individuals living abroad. The thresholds for US expats are:

- Single or Married Filing Separately: If the total value of your foreign assets exceeds $200,000 on the last day of the year or $300,000 at any point during the year.

- Married Filing Jointly: If the total value of your foreign assets exceeds $400,000 on the last day of the year or $600,000 at any point during the year.

If you lived in the US at all during the tax year, you may be subject to the lower thresholds, which start at $50,000.

Which Foreign Financial Assets Must Taxpayers Report?

The IRS defines “specified foreign financial assets” as a broad category that includes, but does not limit, the following:

- Foreign bank accounts and investment accounts.

- Stocks, bonds, and mutual funds held in foreign financial institutions

- Foreign partnership interests.

- Interests in foreign pension plans, retirement accounts, or other similar foreign financial products.

- Foreign real estate that investors hold through an investment vehicle, such as a foreign partnership or corporation.

- Foreign-issued life insurance or annuity with cash value

- Foreign hedge and private equity funds.

- Foreign accounts or non-accounts investments held by foreign or domestic grantor trusts where you are the grantor.

If you hold any of these assets abroad, and their value exceeds the required threshold for your filing status, you must report them on Form 8938.

Double Reporting

Most US expats will need to file an FBAR, however they may not have to file Form 8938. For instance, if you are already filing the Foreign Bank Account Report (FBAR), which also requires you to report certain foreign accounts, you do not automatically need to file Form 8938. You only need to include Form 8938 in your US tax return if your combined maximum amounts in your foreign financial accounts meet the threshold for reporting.

However, it’s important to note that the requirements for FBAR and Form 8938 are separate. You must fulfill both obligations if applicable! The FBAR is filed electronically with the US Treasury. Form 8938 is included directly in your US tax return to the IRS.

Dual-Status or Non-Resident Aliens

If you’re a US expat who is a dual-status taxpayer or considered a nonresident alien for tax purposes, your requirements for filing Form 8938 may differ. These situations can be complex, and verifying whether or not you meet the filing thresholds is crucial. Consulting a Tax Professional at MyExpatTaxes can help clarify your specific situation.

Form 8938 and Real Estate

Foreign real estate does not need to be reported if it is held directly and used as a personal residence. However, if the property is held through certain entities, it may be subject to reporting requirements.

Things get tricky if the property is held through a foreign entity. The foreign entity may be considered a specified foreign financial asset, and its maximum value includes the value of the real estate it has.

Reporting foreign real estate on Form 8938 is complex, but the Tax Professionals at MyExpatTaxes can assist!

Penalties for Not Filing Form 8938

If you’re required to file Form 8938 and fail, you could face an initial fine of $10,000. If you ignore the filing requirement after the IRS notifies you via paper mail, the penalty can increase to $50,000. Additionally, the IRS imposes a 40% penalty on any underpaid taxes related to undisclosed foreign financial assets.

Let MyExpatTaxes Help

Taking precautions when filing your US expat tax return can help you avoid costly mistakes. Ensuring you meet all reporting requirements can be complex, but you can avoid costly mistakes with the proper support. Sign up with MyExpatTaxes today. Let our experienced tax professionals guide you through the process, ensuring you stay compliant and avoid unnecessary penalties!