Filing US Taxes in Korea as an American Living Abroad

October 18, 2024 | Country Guides | 9 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated January 20, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated January 20, 2025

What crosses your mind when South Korea is mentioned? Is it the infectious beats of K-pop, the allure of Korean skincare, or the sizzling flavors of Korean BBQ? Perhaps you envision the serenity of ancient Buddhist temples or ponder the intricate dynamics of its northern neighbor. Now, picture South Korea as your new or soon-to-be home. Join the community of over 150,000 American expats living in South Korea, and as one of them, it’s about time to navigate the terrain of filing your US taxes while embracing the unique charm of South Korea!

We know that when living abroad, one of the last things you want to do is work on paperwork. We at MyExpatTaxes want to help you along the way if you need it.

Expat Taxes in South Korea: Topics We’ll Cover

- Who needs to File?

- Expat Tax Deadlines

- Catching Up

- Tax Filing Status

- Child Tax Credits

- Double Taxation

- Self-Employment Taxes

- Investing from Abroad

- South Korean Property

- Retiring in Korea

- Getting Tax Help

Who needs to file US Expat Taxes from South Korea?

If you live and work in South Korea and are also a US Citizen or a US Green Card holder, you will likely need to file US Expat Taxes from South Korea annually.

According to the IRS general filing requirements, anyone who is either a US citizen OR a Green Card holder and meets or surpasses the minimum income threshold must file US Taxes in South Korea annually. Here is a helpful table to give you an idea of the thresholds.

As you can see, if you meet or surpass the threshold that applies to you, then you will need to get started on your US tax return.

| Expat Tax Tip: It may seem silly to file your US Expat Taxes for $5, but it is a genuine IRS requirement that can be giggled at after you have filed. |

IRS Deadlines for US Expat Filing Taxes in South Korea

Alright, you’ve made it safely to South Korea and have begun to settle into your new digs. You are even making progress on ordering your new favorite street food in Korea when it suddenly hits you: what are your US tax filing deadlines?

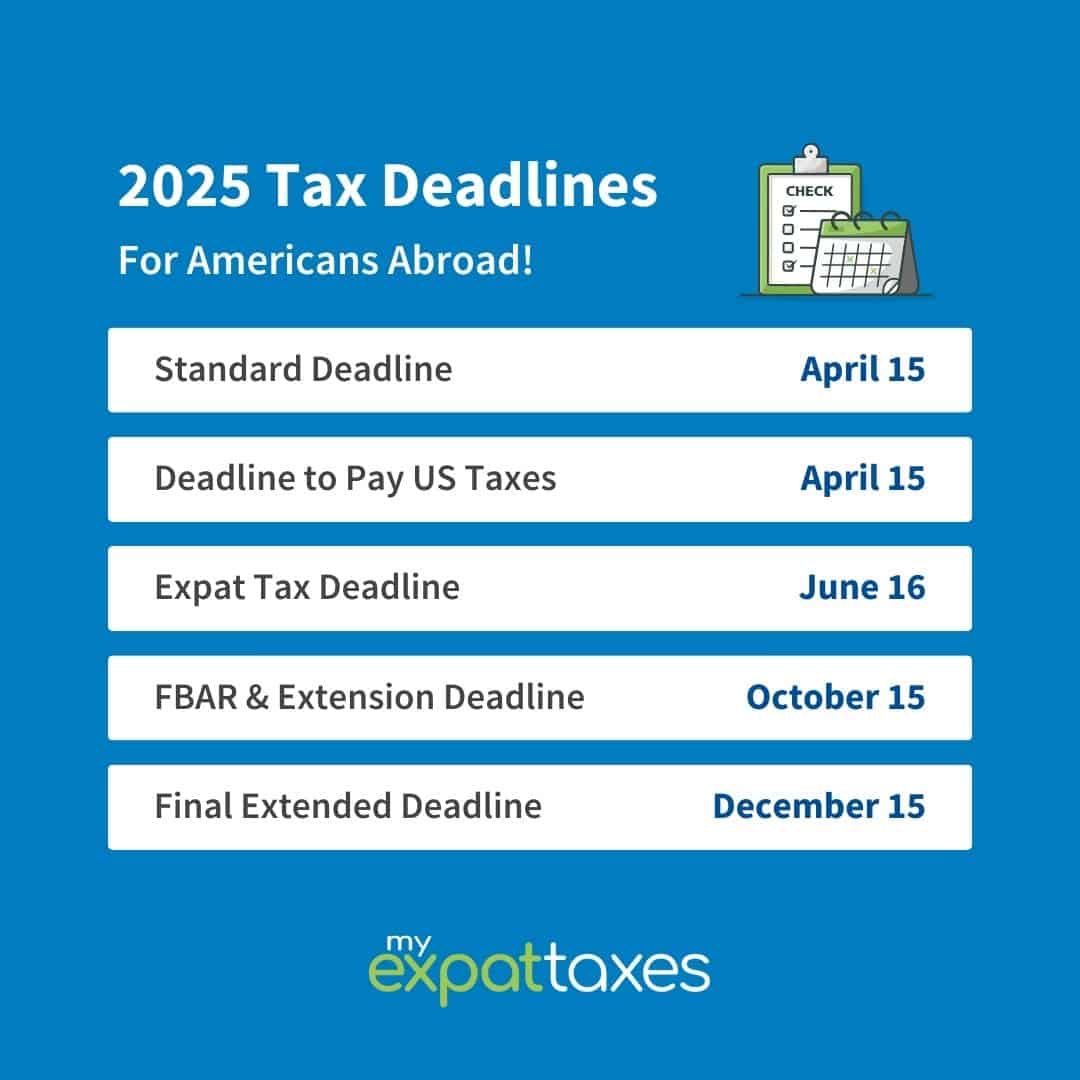

While living in America, the deadline is April 15th of the filing year. But did you know that US Expats automatically receive an extension to June 15th?

If you prefer to complete your taxes by the traditional April 15th deadline, it’s crucial to consider any adjustments due to weekends or holidays. Looking ahead to 2025, the June 15th deadline falls on a weekend. Fortunately, the official deadline is extended to the next business day, which is June 16th. As always, bear in mind that tax payments are still due on the standard deadline – April 15th. Expats benefit from an extension to file, not to pay. We understand it can be perplexing, but staying informed ensures you meet your tax obligations accurately!

| Expat Tax Tip: Set an annual reminder for yourself about a month in advance of the deadline. |

Never Filed Your US Expat Taxes? It’s Time to Get Caught Up!

While you have probably filed US taxes in the past, many Americans are not aware of their tax duties when living abroad. We understand that the US is one of only two countries worldwide that requires citizens and Green Card holders to continue filing even after leaving the country.

While it’s understandable for Americans to continue filing taxes, have you come across the term “Accidental Americans“? Yes, you heard it right – Accidental Americans. An Accidental American is essentially any US citizen who hasn’t resided in the US. For instance, if you happen to be the child of a US Expat, born and raised in South Korea, you fall under the category of an Accidental American, likely with US tax obligations. Let us guide you in understanding your responsibility for filing taxes in South Korea.

Getting Caught Up via The Streamlined Procedure

Accidental Americans and Americans who have left the country and moved abroad without realizing their tax filing obligations can use The Streamlined Procedure.

The Streamlined Procedure was introduced in its current form in 2014 as an amnesty program to allow certain expats who were not compliant with their US tax filing to catch up without facing penalties. With this program, you can catch up on your taxes by filing a limited number of past returns and FBARs.

This program is a helpful service for US expats to utilize. The only thing to note is that you MUST take advantage of this service before the IRS catches up to you. If the IRS takes notice and begins asking where your tax returns are, you will no longer be eligible for this program and may also have some fines to pay.

However, look no further; MyExpatTaxes offers an affordable Streamline Procedure that can help get all of your tax ducks in a row by filing all necessary tax returns and FBARs.

Filing US Tax for Your Family Abroad

We are so glad you are still with us! We know this can be a lot of information all at once, so it is okay to get up and make a cup of tea before you continue.

At this point, we’ve established that you need to file your US income taxes, but what about your filing status?

If you are single, you will file under “Single,” but what if you are married? If you are married and living in the US, you will probably file Jointly, as that typically allows for the best tax breaks. However, if you are married and living in South Korea, you must ask yourself: is my spouse a US citizen?

If the answer is YES, your spouse IS a US Citizen, then you both are required to report your foreign income and assets, so the best option is likely Married Filing Jointly. The IRS doesn’t mind where in the world you live, even in South Korea, if you are a married couple.

If the answer is NO, your spouse is NOT a US Citizen (or US Green Card holder), and you are living outside of the United States, then your foreign spouse is not required to file a tax return. In almost all cases, filing as Married Filing Separately is the best choice. In this case, your spouse’s financial information stays away from the IRS.

Are you the Head of Household? Do you pay more than half of the costs to take care of your home/ household during the tax year with a qualifying child? If the answer is yes, you may want to consider filing as Head of Household.

Child Tax Credits for Families Living Abroad

Regardless of your filing status as a parent abroad, you may qualify to claim the Child Tax Credit. It amounts to $1,700 per child in refundable tax credits during your time abroad living in South Korea. Which overall means more money to visit the Bukchon Hanok Village or for a traditional tea ceremony.

While living in the US, you may have heard about the higher Child Tax Credit. This one, however, requires parents to live in the US for at least half of the prior tax year. It’s an excellent option for new expats, but you will still need to check if you can use the Child Tax Credit and how much you are eligible to receive.

This specific refund is only available if you do not use the FEIE (Foreign Earned Income Exclusion, Form 2555), so if you have a high-earning salary, this may not apply to you.

We want to remind you that more US Expats will not owe any US taxes. However, those in South Korea earning over $126,500 (or the most recent FEIE maximum annual exclusion rate) will likely owe. The reason is that South Korea has a lower tax rate than the US. This means the FEIE is not enough to exclude all of your foreign earned income from US taxation. The IRS still expects you to pay the difference between the two countries’ tax rates to them.

Tax Forms for US Expats in South Korea

If you have worked in the US, you are probably familiar with the 1040, but is your tax form trivia for expats abroad up to date? There is the FEIE, FATCA, FTC, and the infamous FBAR. While there are many others, these are the main ones you should be aware of.

The forms belong to two main tax form categories. For both, you’ll need to be living in Korea legally. So make sure your visa is in order first!

First,

| Number | Forms that help US expats avoid double taxation |

|---|---|

| Form 2555 | The Foreign Earned Income Exclusion (FEIE) gives you credit for the income taxes you paid in South Korea. |

| Form 1116 | the Foreign Tax Credit (FTC), which excludes a certain amount of the income you made in South Korea |

Second,

| Number | Forms to Report Foreign Assets |

|---|---|

| Form 8938 | The Foreign Account Tax Compliance Act (FATCA), a mandatory report to the IRS of foreign assets over $200,000 for singles and $400,000 for married couples living abroad |

| Form 114 | The Foreign Bank Account Report (FBAR), another mandatory report to FinCEN of foreign assets over $10,000 |

Self-Employment in as a US Expat in South Korea

If you haven’t heard it lately, we are proud of you. Not only are you living in South Korea, thousands of miles away from home, but you are also self-employed! Both are no small feats, and it is more than worthy of a pat on the back.

By now, you are familiar with South Korea’s regulations for the self-employed that require local filing, but don’t forget about your American tax return.

3 Important Things to Know for those Self-Employed in South Korea:

- Anyone who earns $400 or more per year from self-employment should be filing US Taxes from Korea.

- US Expats may need to pay around 15.3% of net profit in Self-Employment taxes to the US government.

- South Korea and the US have a totalization agreement, which means you can use the treaty to offset some US Self-Employment taxes.

Many expats make a common mistake when it comes to self-employment taxes – they end up owing the wrong amount on their returns. But don’t worry, with MyExpatTaxes, we’ve got your back! Our goal is to make sure you avoid these errors. That’s why MyExpatTaxes exists—to help regular folks like you navigate taxes without any unnecessary stress.

Basics of Investing as an American in South Korea

Like in the US, there are dozens of ways to invest your money while living in South Korea. As an expat abroad, the US has stricter rules about how you can invest, but don’t let that stop you! Here is a quick guide to get you started.

Common Ways to Invest in South Korea:

RAs/ Roth IRAs: Are you thinking of retiring in the future and looking for a simple way to invest your money? As an expat, you can invest up to $7,000 yearly in a Retirement Account.

Property: Did you know South Korea is one of the few Asian countries where foreigners can buy residential and commercial properties without restrictions? Yep! It makes the property an excellent investment, whether for personal use or investment.

US-based Stocks & Bonds: The easiest way to invest your money and keep things simple is to keep your portfolio US-based. Foreign investment products (like mutual funds) often incur higher fees and tax rates.

Reminder: we will always advise you to check with a local South Korean tax advisor to understand the full scope of responsibilities of having US-based investments while living in South Korea.

Property in South Korea

Over the world, buying property is a common way to invest money. If you are not ready to take that leap, renting is an easy option. As a foreigner in South Korea wishing to purchase property, you should familiarize yourself with the Foreigner’s Land Acquisition Act, Foreign Exchange Transactions Act, and the Real Estate Registration Act.

Buying & Selling Property

Buying: Purchasing a home or apartment in South Korea will not trigger a US taxable event. However, if a large deposit is made into your Korean bank account for your mortgage, you should be prepared to report that on your FBAR and potentially FATCA.

Selling: When it’s time for you to sell your property in South Korea, you will need to diligently document the cost basis and selling fees to ensure you only pay taxes on the sale profits. Just like in the US, you may be able to exclude up to $250,000 or more of the gain from selling your Korean property. You’ll need to satisfy the Section 121 Exclusion requirements, meaning you must have used the property as your primary residency for at least two years out of the prior five.

| Perks of buying in South Korea: | Downsides of buying in South Korea: |

|---|---|

| It can be a great investment return if done correctly. | Residential properties can be costly with high local taxes. |

| Freedom to make the home exactly as you want it. | Selling your property when the time comes can be difficult without a firm grasp of Korean or without the help of a pricey real estate agent. |

| Korea is one of the few Asian countries where you can purchase a home or land in your own name. |

Renting Property while Living in South Korea

Renting: the rental system in South Korea is split into a two-way system. The “jeonse” system is where tenants must put down a large deposit (40-90% of market value) of money before moving in. Afterward, the deposit is returned to the tenant at the end of the lease term if the agreed obligations are met. The “wolse” system requires a significantly smaller deposit in addition to a monthly rent; with the wolse system, you may be able to negotiate with the owner.

| Perks of Renting in South Korea: | Downsides of Renting in South Korea: |

|---|---|

| If you are living in South Korea on a short-term or temporary visa, renting is the easiest option | The two-way system may be challenging to navigate without an English-speaking real estate agent |

| Contracts typically start at one-year stays | If you are looking for a short-term (less than one year) apartment, you may be hard up to find a place without roommates |

| Accommodations will likely be much smaller than what you are used to in the US |

As with US rental income, you must report any and all rental income and expenses from your Korean properties on your US Tax Return via Schedule E. The South Korean government calculates depreciation differently than the US, so why not let MyExpatTaxes figure that out for you?

How the Foreign Housing Exclusion Works:

Another great way to reduce your US tax bill is by using the Foreign Housing Exclusion. It accounts for expenses associated with your foreign housing, such as:

- Rent

- Utilities

- Property Insurance

- Household repairs

- And more!

US Expats Retiring Abroad in South Korea

Is there nothing dreamier than retiring abroad? Now that you are retired, you have more time to learn about the deep history of South Korea and travel throughout Asia with ease.

But before you get there, you may want to consider saving up for retirement! Here are some account options:

1) South Korean pension through your employer! Yes, that’s right. However, keep in mind any contributions your employer makes to your pension are taxable in the US in the year contributed. That just means it’s not deferred; however, normally, this does not impact your US taxes in a significant way.

2) South Korean state pension – thanks to the agreement between the US and South Korea, this income is ordinarily exempt from US taxation

3) US Individual Retirement Account (IRA)

4) US Social Security Benefits

Get Help Filing US Taxes in South Korea from the Experts!

Phew, you’ve made it through the guide. If you are still unsure about how to get started on filing your US Expat Taxes from South Korea, let the experts here at MyExpatTaxes help! Our Help Center is a great launching pad to get you started, and when you are ready to begin your tax return, you can find help via our Support Specialist Chat at any time for extra support.

For those still deciding where to go, we’ve got guides on Hong Kong, Dubai, France, and More!

Why File with MyExpatTaxes?

1) We were made by expats, for expats. We know the headaches that come with US Expat Taxes; let us help you ease that pain with the help of our experts.

2) Transparent pricing. We won’t surprise you with the costs! We are always clear and upfront about filing with MyExpatTaxes.

3) You can e-file with us. In fact, we e-file 99% of all expat tax returns, which means you can forget the hassle of filling your printer’s ink cartridges, even when filing US taxes from Korea!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

October 18, 2024 | Country Guides | 9 minute read