US Taxes for Americans Expats Living in France Guide

October 21, 2024 | Country Guides | 7 min read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated January 20, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated January 20, 2025

Living the dream in France, from Parisian streets to Provence villages and the French Alps, is amazing. However, you are still obligated to file US expat taxes – even when you’re in France. Handling US taxes as an expat doesn’t need to be overwhelming. Utilizing tax treaties and provisions, you can efficiently manage your obligations, allowing you to savor baguettes, brie, and the stunning landscapes. Whether on Cote d’Azur beaches or ski slopes, your tax responsibilities can seamlessly blend into your French adventure.

You’re settling in, but between a relaxing weekend on the beach in Saint-Tropez and your weekly trip to the market, you remember it’s time to file your taxes. Not to worry! This guide is for expats like you.

Expat Taxes in France: Topics We’ll Cover

Who Needs to File US Taxes in France While Living There?

All US citizens who meet the minimum income threshold must file a US tax return, even when they live in France – or elsewhere, for that matter. The minimum income thresholds differ depending on your tax filing status.

Now you know you may need to file, let’s consider the factors for who qualifies as needing to file a tax return. The IRS’s general filing requirements require US citizens or US Green Card holders whose income during the tax year meets or surpasses the minimum income threshold to file a tax return.

| Single | $14,600 |

| Married Filing Jointly | $29,200 |

| Married Filing Separately | $5 |

| Head of Household | $21,900 |

| Qualifying Widow(er) | $29,200 |

| Self-Employed* | $400 |

If your 2024 income meets or exceeds the thresholds in the table, you’ll need to file a tax return.

| Expat Tax Tip: If you’re living in France and married to a non-US Citizen, you will probably file as Married Filing Separately. In that case, you will need to file a US Tax Return from France if you make more than $5. |

IRS Deadlines for US Expats

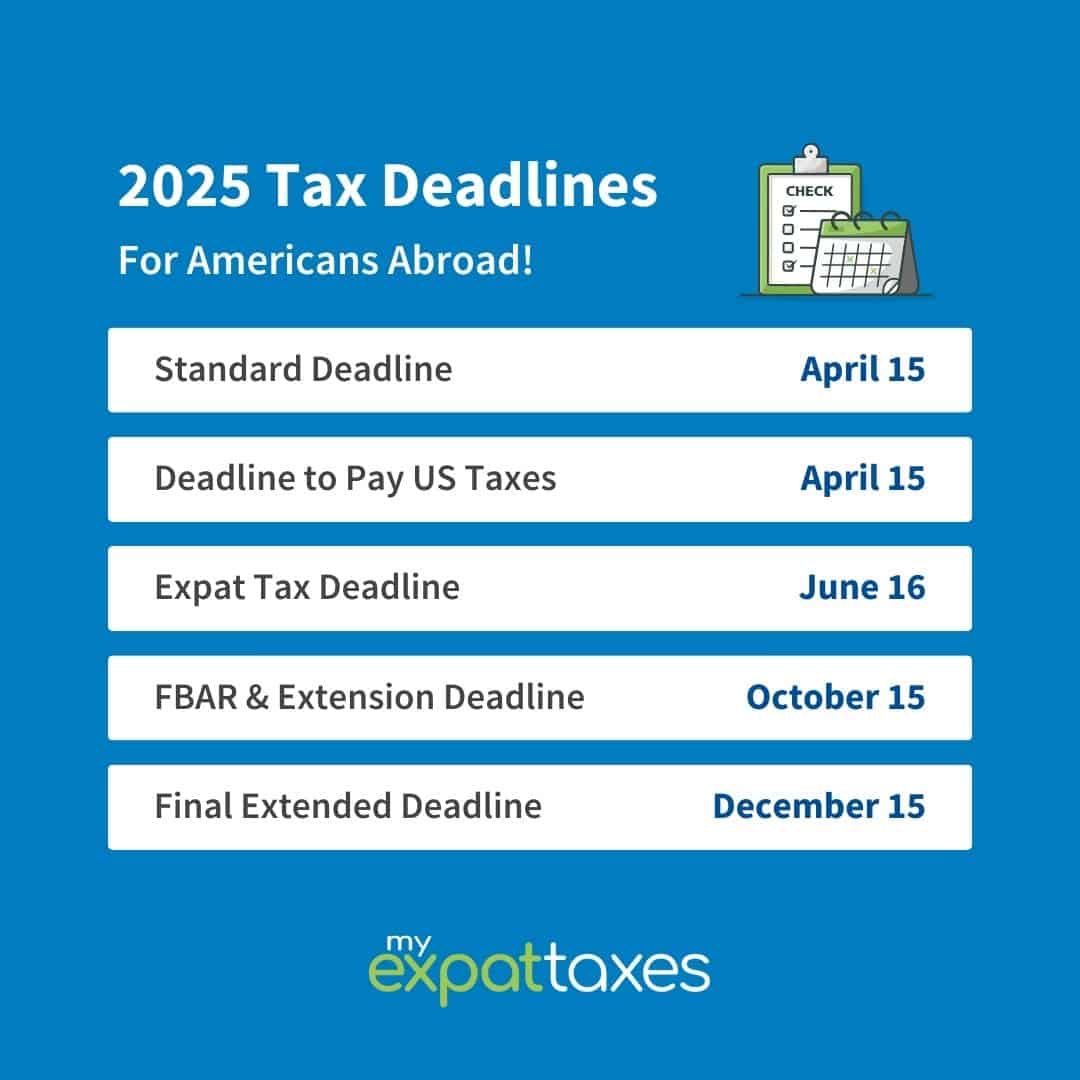

Living abroad means you may qualify for a later tax deadline as an American abroad! You are probably familiar with the April 15th deadline, but there are other deadlines to be mindful of as an expat.

Note: If the deadline is on a weekend or holiday, that deadline, as well as the corresponding extensions, are pushed forward. This year, 2025, the June 15th deadline will fall on a weekend, moving the official filing date to June 16th.

Never Filed Abroad? Catch up from France

If you have US citizenship or a US Green Card, maybe it’s no surprise you may need to file US taxes yearly, even from France.

Getting Caught Up via The Streamlined Procedure

Whether you’re an Accidental American or an American who moved abroad later in life, the Streamlined Procedure can help. The IRS created the Streamlined Procedure to assist Americans who may not have been aware they must file a US tax return. The Streamlined Procedure allows Americans to catch up by filing a limited amount of past tax returns and FBARs. Best of all, it comes without penalty from the IRS!

| Expat Tax Tip: Move quickly! You need to use The Streamlined Procedure BEFORE the IRS notices you’re behind. This way, you’ll avoid potentially hefty fines! |

So, why does the IRS offer this program? The program encourages anyone who unknowingly fails to report their income and foreign assets, saving the IRS from having to chase down accidental “tax evaders.”

MyExpatTaxes offers a highly affordable price for the Streamlined Procedure, which includes all the tax returns and FBARs required by the IRS. Plus, we include the review of a Tax Professional to support you and sign off on your submission.

Filing US Taxes for Your Family Abroad

Who should file Jointly or Separately from their spouse if you’re married? If you’re married and living in the US, consider filing jointly to receive the best tax breaks. But how should you file when you are married and living in France?

Honestly, it depends: Is your spouse an American citizen?

If your spouse is a citizen or Green Card holder: The best option is likely to file as Married Filing Jointly. Both of you must report your foreign income and foreign assets, which makes little difference to the IRS if you’re married and living abroad.

Your Spouse is a non-US Citizen: Most often, filing as Married Filing Separately is best. Your foreign spouse does not have to file a US tax return if you live outside the US.

Child Tax Credits for Families Living Abroad

Most expat parents are eligible for the Child Tax Credit. The credit allows you to claim up to $1,700 per child as a refundable Child Tax Credit when living abroad in France. Most expats won’t owe US taxes, meaning you will likely receive the total amount as a tax return. Awesome!

Have you heard about the new, higher Child Tax Credit? It requires you to have lived in the US for at least half of the tax year. Does that sound like you? Read more about the Child Tax Credit qualifications.

| Expat Tax Tip: MyExpatTaxes’ tax software will automatically confirm if you qualify for the refund. Already filed? You can have one of our Tax Professionals review a previously filed US tax return to determine if those are eligible, too! |

Another option, if you have dependent children, is to file as Head of Household.

Head of Household: If you pay more than half in maintaining your household and have a qualifying child during the tax year, you can file as Head of Household.

Tax Forms for Expats in France

Not just your average 1040 form! There are a few more tax forms Expats in France should know. Let’s look at the two most common expat tax form categories: forms to help avoid double taxation and forms to report your foreign assets.

Self-Employment in France

What does moving to France and self-employment look like? To you, maybe that means WFH on the beaches of Nice for a week or schedule flexibility to explore a new cafe for lunch. Look at you! But how does a self-employed expat file their US taxes?

| 3 Things for self-employed US expats in France to know: |

|---|

| Anyone who is self-employed and earning $400 or more per year must file a US tax return regardless of filing status. |

| Expats could pay about 15.3% of their net profit in Self-Employment taxes. |

| Since France has a totalization agreement with the US, you can use the treaty benefit to help offset US Self-Employment taxes. |

A common mistake for expats using US-based tax software is being misidentified and charged with US self-employment taxes. Avoid this by using MyExpatTaxes! That way, you won’t pay more taxes than you should.

Basics of Investing as an American in France

Although the US has strict guidelines for expats investing, it’s not impossible. Once you learn investing rules for expats, it can be easy – let’s have some fun!

Common Ways to Invest in France:

- Property: You can buy property as an American living in France for personal use or investment.

- IRAs/Roth IRAs: Expats can invest up to $7,000 annually in a Retirement Account. Start today!

- US-based Stocks & Bonds: Keep it simple and keep your portfolio US-based. Avoid investing in foreign investment products like mutual funds based outside of America to avoid fees and high taxes.

Suppose you have invested in French mutual funds; do not worry! MyExpatTakes makes it easy to report these investments to the IRS on Form 8621 (PFICs).

Property in France

Buying & Selling Property

Buying: Are you considering buying property abroad? You’re not alone! Although housing prices are increasing, many people are moving to France to take advantage of low interest rates on home mortgages.

Purchasing a home in France is not a US-taxable event. However, a large deposit into your France bank account for your new mortgage requires a report on the FBAR and possibly Form 8938.

Selling: If you are considering selling your foreign property, it is necessary to correctly document the cost biases and selling fees. That way, only the profit from the sale will be taxed. Similar to US properties, it is possible to exclude up to $250,000 or more of gain from the sale of your French property. However, you must satisfy the Section 121 Exclusion requirements to qualify.

Perks of buying in France:

- The freedom to make your own decisions

- Potential to build equity and return on your investment

- The stable property market in France

Downsides of buying in France:

- France has high property taxes, whether you’re an expat or not

- Buying in France for foreigners can be a relatively lengthy process (about three months!) that comes with high fees

Renting Property

Renting is more common in metropolitan areas such as Paris because of the high cost of housing, compared to rural areas where buying is most common.

Perks to renting in France:

- Flexibility! You can do exactly what you came to France to do as an expat. Explore!

- Renting can save you money if you’re a short-term expat in France. Compared to buying, however, you’re unlikely to see a profit in the short term because of France’s high property fees.

- French property laws often favor the tenant.

Downsides to renting in France:

- Finding affordable rent in your preferred neighborhood can take a lot of work.

- Long-term commitments. Unfurnished apartments often require a 3-year minimum lease contract, which may be less desirable for expats.

The Foreign Housing Exclusion:

There is yet another way to decrease your US tax bill for France housing. The Foreign Housing Exclusion considers your foreign housing expenses, such as:

- Rent

- Utilities

- Property Insurance

- Household repairs … and more!

Retiring Abroad in France

What a fantastic way to celebrate your retirement through life as a French expat. If you’re looking forward to retirement, consider saving up through these accounts:

- French pension through your employer – this is only taxable in France if you have a French employer

- French state pension, such as the compulsory supplementary pension scheme ARRCO-ARGIC

- US Individual Retirement Account (IRA)

- US Social Security Benefits

Get Help Filing From the Experts

We here at MyExpatTaxes are here to help. Even after reading our guide to expat taxes in Norway, we realize you may still have questions. Don’t worry! We are the experts! Use the Help Center, get in touch with a Tax Professional, or simply start your tax return and chat via our live help for any support.

Why file your US expat taxes from France with MyExpatTaxes?

Expats made it for expats! We recognize how difficult it can be to tackle your taxes while living abroad. MyExpatTaxes makes it easier.

Clear Prices: You won’t find any surprises with us! We are clear and open about how our pricing works and what you’ll need to pay.

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

October 21, 2024 | Country Guides | 7 min read