US Taxes for Digital Nomads in 2025

November 24, 2024 | Digital Nomad | 8 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated January 24, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated January 24, 2025

In the age of technology, many US expats are embracing the digital nomad lifestyle. But even as a digital nomad, US citizens still need to be thinking about their tax obligations. Here is what all US expats should know about taxes as a digital nomad.

Do Digital Nomads Have to File US Taxes?

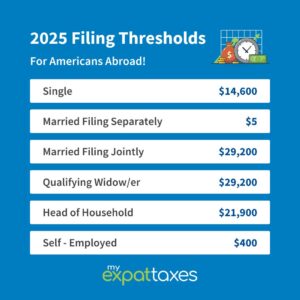

You must file a US tax return if you’re a digital nomad with US citizenship (or Green Card) and worldwide income exceeding a certain tax threshold. Check below for the income tax thresholds for 2025.

Accidental Americans

In some situations, digital nomads have no clue they are subject to US taxation. This situation is common among Accidental Americans who acquired US citizenship through their parents while living abroad or were born in the US but moved out of the country.

Filing and Paying Foreign Taxes

Taxation Systems Around the World

- Citizenship-Based: A country taxes its citizens regardless of their status and location as a resident. The US is the top example of utilizing citizenship-based taxation.

- Residential: No matter where a citizen of that country earns money, they pay income tax to that country. This is commonly used in countries like Japan or Australia.

- Territorial: Taxation is based on citizens’ income only within the country. Regions such as Hong Kong and Singapore use this tax system.

Regarding foreign taxation as a digital nomad, where you earn the income matters. You must check with your host country’s tax laws and rules to ensure tax compliance.

Foreign Residency Rule

Many countries have residence-based taxation, which means if a person spends at least six months or 183 days in the country, they would need to file and possibly pay taxes to their host country.

Collecting the Right Forms

Whenever anyone starts filing US taxes, they need to ensure they have the correct documents ready. Here are some of the essential documents that a digital nomad might need.

Income Documentation

- Invoices from freelance or contract work

- Payslips from employers, whether US-based or foreign

- Receipts or sales records if you run your own business

- Tax withholding forms like a W-2 or Form 1099 for contract work

- If your income is from investments, rental properties, or other passive sources, include:

- Bank account statements for FBARs and FATCA Form 8938

Do Digital Nomads Have to Pay US Income Taxes?

Many US expats, including digital nomads who are not self-employed, often owe no income taxes to the IRS after applying for the Foreign Earned Income Exclusion or Foreign Tax Credit. Digital nomads can use the Foreign Earned Income Exclusion (FEIE) to Foreign Tax Credit (FTC) to offset their US tax liability.

Foreign Tax Credit

The FTC calculates the foreign taxes already paid, converts them to USD, and then allows you to use it as a credit toward your US tax liability. For example, say you have paid €300 to the German government. After converting the euro amount to US dollars, that €300 equals $315 (in 2025). This dollar amount can be used as a credit towards your US tax liability.

Foreign Earned Income Exclusion

Another tax benefit that digital nomads can utilize is the FEIE, or Form 2555. The FEIE allows US expats to exclude up to $126,500 of foreign earned income.

For digital nomads to be eligible for the FEIE, they must pass one of these two tests:

Bona Fide Residence Test: Were you a registered resident subject to local income taxes in your host country for at least a full calendar year? Then, you can claim the FEIE for up to the maximum amount ($126,500).

Physical Presence Test: You will need to be outside of the US for 330 full days in a consecutive 12-month period that begins or ends in the tax year. If yes, you qualify for the FEIE. Depending on your qualifying period, you may have to adjust the maximum FEIE amount you can take.

Source: Expat Tax Benefits

Foreign Bank Account Reports for Digital Nomads

Having foreign financial accounts as a digital nomad is common, but even these must be considered when filing US taxes. The Foreign Bank Accounts Report requires US citizens to report foreign financial assets that collectively exceed $10,000 at any point during the year.

Digital nomads must submit their FBARs by October 15th to the Financial Crimes Enforcement Network (FinCEN). If you want to have all your financial requirements in one place, you can sign up to use the MyExpatTaxes software, which files your FBAR and US tax returns together!

Self-Employment Taxes for Nomads

Many US digital nomads are self-employed. Making them liable for paying US self-employment taxes. To prepare, set aside about 15.3% of your income to pay your US taxes. This will cover your Social Security taxes of 12.4% and Medicare taxes of 2.9%.

Unfortunately, self-employment taxes aren’t excludable through the FEIE and FTC. However, suppose you live and work in a country with a Totalization Agreement with the US. With this Totalization Agreement, you may only need to pay Social Security to the foreign country.

Rules for Social Security Taxes for Digital Nomads:

“If an American citizen or resident alien is sent to a foreign country for five years or less to work for the same American-based employer, they would generally remain covered by the US Social Security system.”

If the same taxpayer were sent abroad for longer than five years, they would pay Social Security taxes to the foreign country.

If the taxpayer is employed by a foreign employer or was hired by an American-based employer while living overseas, he or she would pay social security taxes to the foreign country. (If the foreign employer is an affiliate of an American employer, the American employer can enter into an agreement under section 3121(l) to have United States social security coverage for the services of United States citizens and United States residents performing services for the foreign employer.”

What are the Digital Nomad Tax Deductions?

As a self-employed digital nomad, you can deduct certain business expenses from US taxation. Some examples of business expenses are:

- Mobile and internet service

- Office equipment like a laptop, stand, blue-light protective glasses

- Marketing and social media advertisement expenses

- Fees for website hosting and domain purchasing

- Home office space

- Educational courses and costs related to your business

- and more

State Taxes

Depending on when and which state you have lived in will determine if you need to file US state taxes. Taxes may be imposed on you if you live or earn income in one of the following states: California, New Mexico, South Carolina, or Virginia. A driver’s license from one of these states could make it, so you must file state taxes.

To avoid filing and paying state taxes, you can temporarily move to a less complicated tax state before working abroad.

Before moving to a US state for tax reasons, check the state’s specific rules and laws regarding taxation. It will help determine whether you will file US state taxes as a digital nomad.

Digital Nomad Support

Being a digital nomad is a dream come true, but tax regulations still apply to you no matter where you are. With MyExpatTaxes, our trusted Tax Professionals can help you file your US taxes quickly and easily. No matter how complex the case, MyExpatTaxes is ready to assist you.

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

November 24, 2024 | Digital Nomad | 8 minute read