FBAR Penalties for US Expats – Get Caught up Now

November 15, 2022 | Foreign Bank Account | 5 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

All blogs are verified by IRS Enrolled Agents and CPAs

All blogs are verified by IRS Enrolled Agents and CPAs

One of the first things an expat may do once they move abroad is secure a foreign bank account. However, when tax season comes, you may forget to file an FBAR due to your account, FBAR penalties for expats are possible.

Don’t fret just yet, because while penalties are a reality, the truth is – if the IRS hasn’t contacted you yet about failed FBAR filings, you still have an opportunity to make it up penalty-free.

What is the FBAR

You are currently viewing a placeholder content from YouTube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationThe FBAR – or Foreign Bank Account Report – is a form US citizens living abroad must fill out if they reach a certain threshold in their bank accounts.

File an FBAR when you have at least $10,000 or more total from all financial accounts outside the US at any one time during a calendar year.

You won’t be taxed on your foreign bank account. You’re only reporting information about how much money is your foreign bank account(s) to the Financial Crimes Enforcement Network (FinCEN), which is part of the US Department of Treasury. You don’t file the FBAR directly to the IRS but FinCEN.

You may ask why do I need to tell the US Treasury how much is in my foreign bank accounts? The truth is, as more and more US Americans are moving abroad, illegal money laundering is a possibility the US government wants to crack down on.

According to the IRS, the following individuals must file an FBAR, if they are eligible:

- US citizens, including expats who live abroad

- Estates

- US residents

- Trusts

- US corporations, partnerships, LLCs

Following through with your US tax duty every year, including reporting your financial assets through the FBAR, is only one time of year and keeps your tax case in good standing!

Deadline to File the FBAR

You may assume the deadline to file the FBAR is April 15, the typical tax day for Americans living in the US. But like the filing deadline for Americans abroad, there is an automatic extension for the FBAR.

As an expat, you don’t need to file an additional form to request an extension. American expats automatically have time until October 15 to file the FBAR.

If you are affected by a natural disaster like a tsunami or flood abroad, the US government may be able to extend your FBAR due date. Be sure to reach out to one of our Tax Professionals for more assistance on this matter!

FBAR Penalties for Expats

If you think you could get away with not filing and reporting the FBAR every year, you may be liable to pay hefty penalties. Tax penalties are also included if you forgot or didn’t know you have to file. However, there may be a workaround to not pay the penalties, which we’ll get to in a bit.

Expats may be subject to paying penalties for violating FBAR regulations, depending on each one’s circumstance.

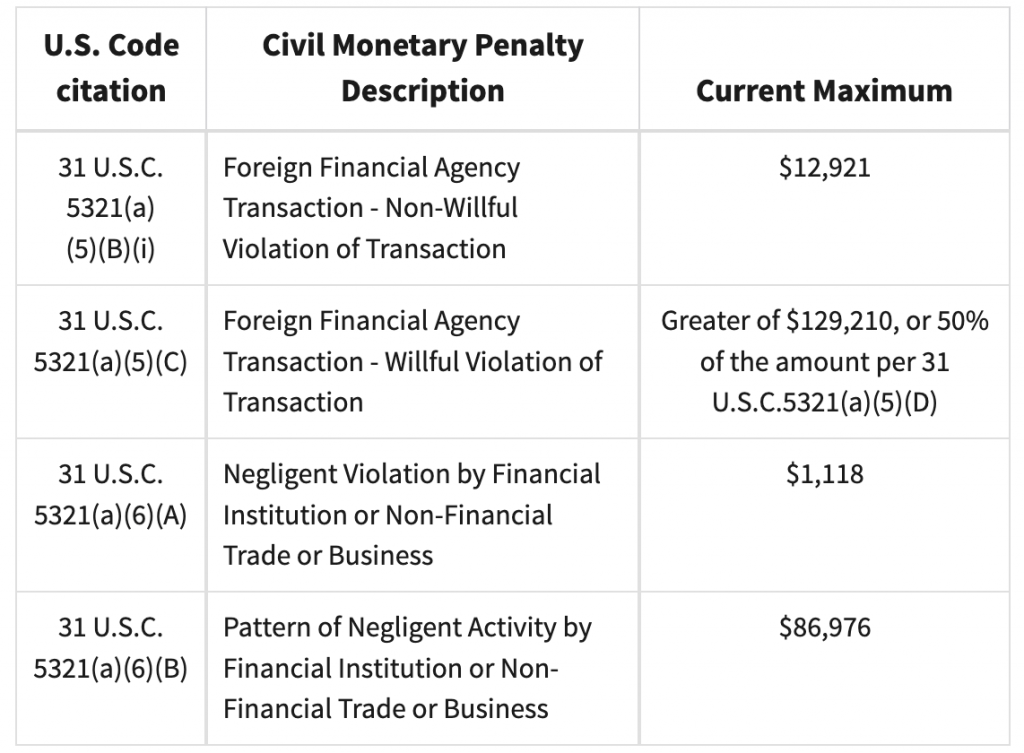

These are the current maximum penalties, which, as you can see, are expensive FBAR penalties for expats:

Filing Delinquent FBARS

If you decide to file an FBAR late, you may be subjected to $1,000 or more penalties. However, if the IRS hasn’t contacted you yet, there is a chance you can file late FBARS using the Streamlined Procedure and avoid paying penalties. See What Happens if I Forgot to File the FBAR? Below.

How to Keep Records for the FBAR

Before you report the FBAR, you should keep good records for each foreign financial account like:

- Your full name and foreign address

- Foreign Financial Account Number

- Name and address of your foreign bank(s)

- Type of foreign financial accounts

- The maximum value during the year

To keep good records, we at MyExpatTaxes suggest collecting bank statements and keeping track to ensure once you reach the $10k threshold, you’ll file the FBAR. The IRS insists on keeping up to five years of these records in case a situation comes up.

How to File the FBAR

According to The Balance, with being the best US tax software for expats, expats can quickly fill out an entire tax return, including the FBAR, as quick as 30 minutes.

MyExpatTaxes software asks simple questions like whether you have foreign financial accounts and more than $10,000 combined from these accounts. If you answer in the affirmative, you’ll be directed to fill in your bank info. The software will automatically generate FinCEN Form 114 for you!

If you don’t understand the questions, you can click on the question mark icon, and information will pop up to explain more. Our tax team is also available via live chat to answer any questions you have.

Most importantly, if you are unsure whether you need to file an FBAR, we suggest being safe and filing one anyway. As we explained above, the penalties can be enormous if you don’t file.

The FBAR section on our app is easy to fill out and offers all the guidance you need as an American expat to complete it effectively. Furthermore, we require you to add all your non-US accounts in our software through straightforward instructions. Once you fill everything out, you’re done!

What if I don’t need to file a tax return?

No problem! You can still access all of the expert knowledge of MyExpatTaxes CPAs and Enrolled agents using MyExpatFBAR. Learn all about your FBAR filing online and how we can help! Including access to live support chat each step of the way!

Accounts That Don’t Require the FBAR

Did you know not all foreign financial accounts need to be reported on the FBAR? The IRS provides a list of what those are:

– Correspondent/Nostro accounts,

– Owned by a governmental entity,

– Owned by an international financial institution,

– Maintained on a United States military banking facility,

– Held in an individual retirement account (IRA) you own or are beneficiary of,

– Held in a retirement plan of which you’re a participant or beneficiary, or

– Part of a trust you’re a beneficiary if a US person (trust, trustee of the trust, or agent of the trust) files an FBAR reporting these accounts.

IRS

You don’t need to file the FBAR if all your foreign financial accounts are reported on one consolidated FBAR form. Plus, any foreign financial accounts you own with your spouse, and your spouse is authorized to file on your behalf (you need to have signed FinCEN Form 114a for this).

What Happens if I Forgot to File the FBAR?

Did you realize you forgot to file the FBAR? Or maybe you found out you should have filed but missed the deadline? No need to worry because many American’s living abroad have FBARs that are past due, which is why the IRS created two amnesty programs to help expats get back on track.

The Streamlined Filing Procedures help US citizens abroad make up six years of FBARS, plus three years of tax returns (if needed) without getting penalties. However, there are a few requirements to use the program, and you must be in good faith with the IRS – meaning you purposely didn’t try to avoid your filing obligation.

Our expat tax software has all the forms you need to use the Streamlined Procedure while offering the most affordable online package. Getting caught up on FBARs, and tax returns have never been more straightforward and suitable for the budget.

It’s crucial to become fully tax compliant because the IRS is cracking down on expats with suspicious tax cases due to better technology. If you get caught, you won’t be able to use the Streamlined Program and be subject to $10,000 or more penalties.

Ready to Get Back on Track?

Our one-of-a-kind expat tax software offers all the tools and forms to prevent FBAR penalties for expats. Plus, we have a team of friendly Tax Professionals who can help you whenever you run into obstacles along the way.

With MyExpatTaxes or MyExpatFBAR it’s easy to become – and stay – fully tax-compliant! File today!