Second Stimulus Checks for US Expats

December 21, 2020 | Stimulus Checks | 3 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated November 26, 2024

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated November 26, 2024

As the pandemic continues, the majority of the first stimulus payments have already been used by Americans worldwide. A second check has been released to US expats outside the US and citizens within the US. There is even talk of a third one emerging.

Second Stimulus Checks for US Expats

US congressional leaders agreed to a new $900 billion coronavirus rescue package that includes a second wave of stimulus checks. The vote for the bill happened on December 21, 2020.

The second stimulus payment amount is $600 per qualifying taxpayer. This is half of the $1200 check approximately every American received this year. Then, each qualifying dependent (child under 17 with a US Social Security number) will get $600, which will be added to the taxpayer’s check.

When Can Expats Receive the Second Stimulus Check?

The first payments started the last week of December, with more released in early January. The first to go out were direct deposit payments to individuals with valid US bank accounts the IRS had on file. Then, mailed payments followed – sent as a paper check or a debit card.

It is possible to check the status of your stimulus payment via the IRS Get My Payment portal.

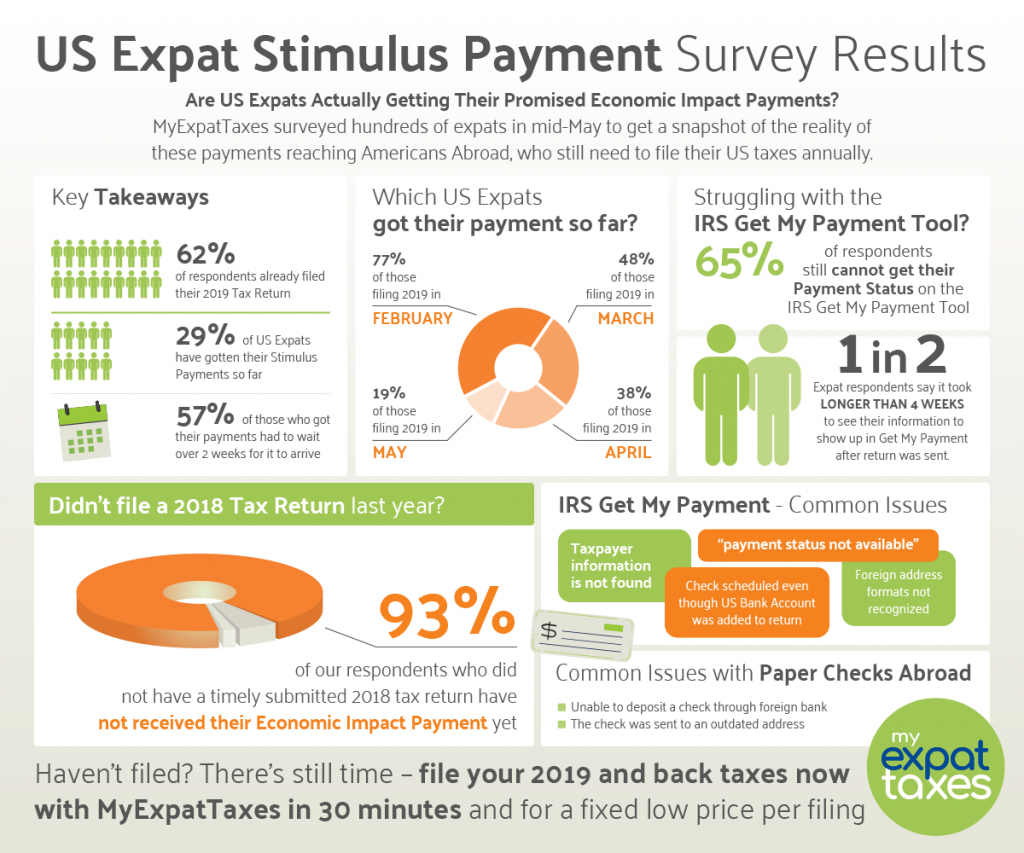

We hope that US expats will receive their second check in a timely manner. We found through our customer survey in May that 57% expats received a stimulus payment two weeks or more after filing their 2019 tax return. Most surprising, the majority of survey takers stated it took at least four weeks or longer to receive the check.

How Expats Can Get the Second Check

How will Americans on land and abroad get the second stimulus check? It depends on how they got the first one.

If you received your first stimulus check:

By Direct Deposit: The second check should arrive the same way with no further required action on your side.

By paper mail: The IRS may reopen the Get My Payment Tool so you can add in your US bank account details for a direct deposit. Don’t have a US bank account as an American expat? Try to get one using an online bank service such as Transferwise. Please note, while Transferwise did work for a majority of Stimulus Payments in 2020, in some instances, it did reject some IRS payments due to fraud protection measures.

If you need to catch up on your taxes as an American living abroad to receive the first and second stimulus payments, you can utilize our Streamlined Procedure expat tax software.

Qualifying for Stimulus Checks

If you didn’t qualify for the first Stimulus check this year, you might be able to as an expat for 2021. The value of stimulus checks was from calculating previous years’ tax returns. From this, some US citizens weren’t eligible to receive the check.

However, for American citizens living abroad, previous tax returns can be re-evaluated for the coming year. This is based on your 2020 income. Yet, only if you claimed the Foreign Earned Income Exclusion to reduce the adjusted gross income, or earned less income in 2020.

Look to file a 2020 tax return in February with us!

Recovery Rebate Credit

As a US expat who files 2020 taxes with Form 1040 or Form 1040-SR, you may also be eligible for the Recovery Rebate Credit.

The Recovery Rebate Credit is authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Any eligible individual who did not receive the full amount of the recovery rebate as an advance payment, also known as an Economic Impact Payment, can claim the Recovery Rebate Credit on a 2020 Form 1040 or Form 1040-SR.

Generally, this credit will increase the amount of your tax refund or lower the amount of the tax you owe.

IRS

These forms can be used by people who are not normally required to file tax returns but are eligible for the credit.

The Heroes Act Proposal

For some background, The House of Representatives passed the Health and Economic Recovery Omnibus Emergency Solutions – or HEROES Act – in May. This is a second relief package after the Coronavirus Aid, Relief and Economic Security (CARES) Act.

The HEROES Act includes special provisions for eligible Americans and expats to receive a second stimulus payment. It proposes a $1200 check, with gross adjusted income under $75,000, reported on their 2018/2019 tax return. Then, for married individuals filing jointly, the payment is doubled.

As a note, adjusted gross income for an American abroad comes after you apply the FEIE on your tax return.

Additionally, the HEROES act includes providing the stimulus payment getting reduced for every $100 of adjusted gross income that exceeds the threshold. As a US citizen abroad, you can still be eligible for the payment if you file jointly with a foreign spouse and that spouse doesn’t have a SSN.

US Expats, Stimulus Checks & Taxes

Need to catch up on your US taxes to receive the first and second stimulus payments? Please sign up for our software! We will then be able to show you how you can become tax compliant in no time.

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

December 21, 2020 | Stimulus Checks | 3 minute read