The W-9 Form for Expats: Your Ticket to Smooth Tax Compliance

February 15, 2024 | Tax Forms | 4 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated December 26, 2024

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated December 26, 2024

When you see the IRS “W-9” tax form, it may seem like a corporate document only big companies use, but that assumption is far from the truth. The W-9 form is critical in ensuring accurate tax reporting for any freelancer, contractor, or just earning income from sources in the US.

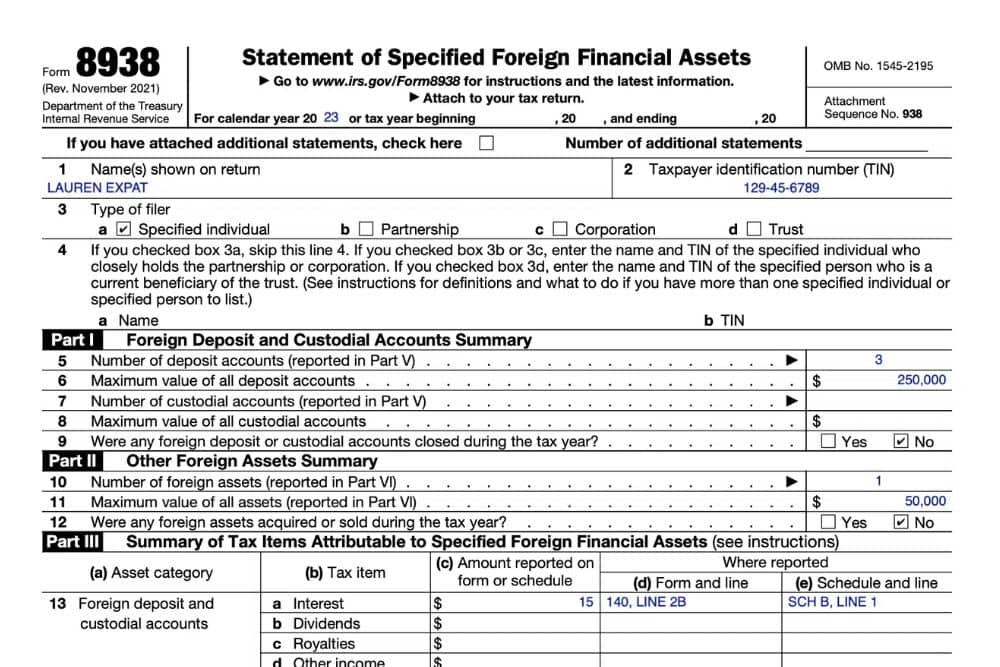

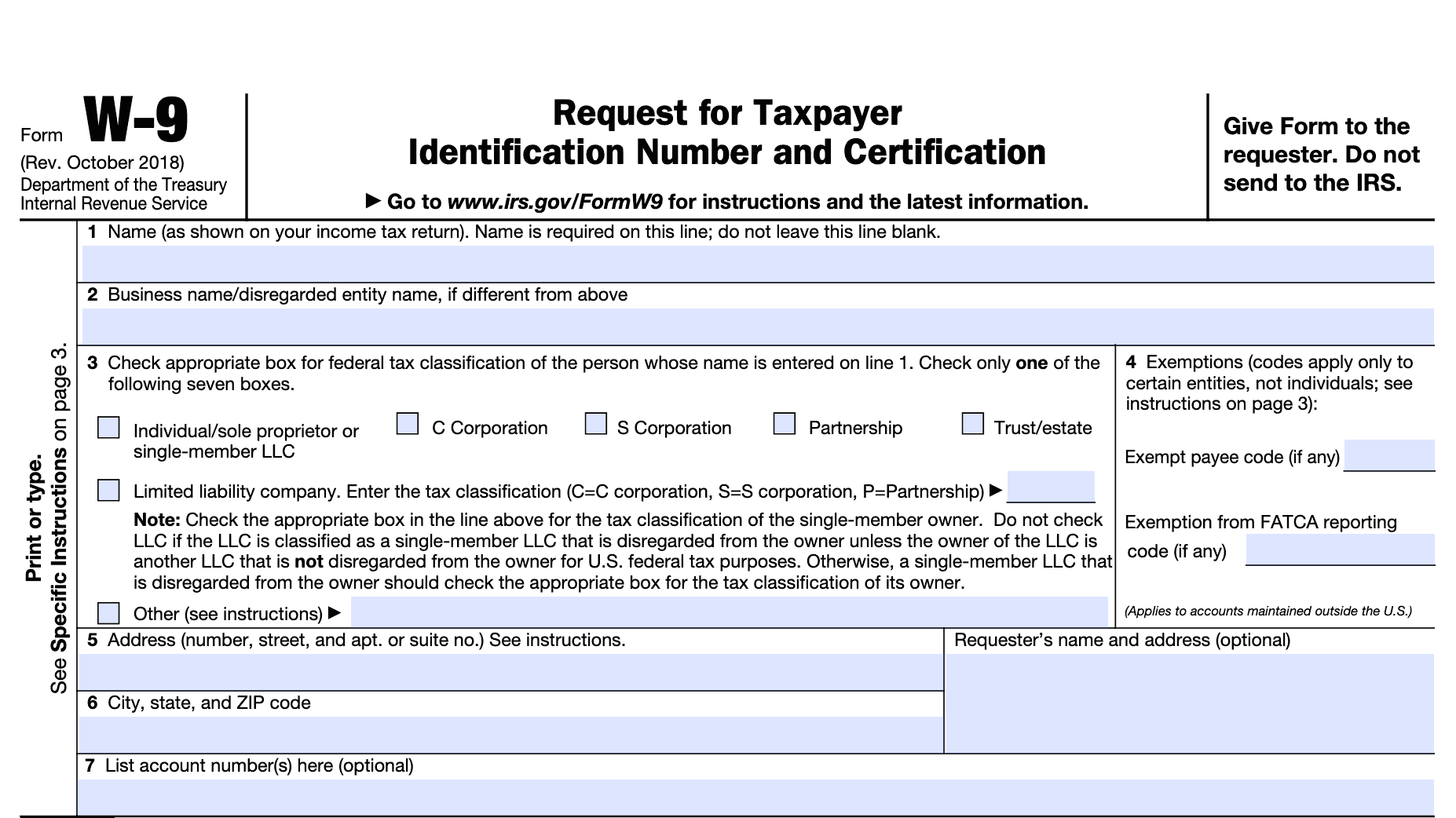

The W-9 form, formally known as the Request for Taxpayer Identification Number and Certification, is a critical document in the United States tax system. Individuals and entities use it to provide their Taxpayer Identification Number (TIN) to the person required to file an information return with the Internal Revenue Service (IRS). If you’re a US expat earning income from sources within the US, this form is essential for accurate tax reporting.

Ensuring you understand and correctly fill out a W-9 form helps you remain transparent with the IRS and avoid potential tax penalties. The information provided on this form allows the IRS to track income paid to you and contributions you made to an Individual Retirement Account (IRA). It also records real estate transactions, mortgage interest payments, and other financial activities.

W-9 vs Other Tax Forms

While the US tax system is filled with numerous forms, the W-9 stands out for its specific role. Unlike the W-2 and 1099 forms, which are used to report wages, salaries, and other types of income, the W-9 form is about providing your Taxpayer Identification Number (TIN) to the person or entity needing to file an information return with the IRS.

Another notable distinction is that while forms like the W-4 and W-2 are typically associated with traditional employment, the W-9 form is often used by freelancers, independent contractors, and other self-employed individuals. This is because the form allows businesses to track payments made to non-employees.

Additionally, while some tax forms, like the 1040, are filed directly with the IRS, the W-9 is usually submitted to the individual or organization that has paid you. They then use this information to complete their tax documents.

The W-9 form plays a unique role in the US tax system, particularly for US expats and self-employed individuals.

When to Fill Out a W-9

Understanding when to complete a W-9 form is crucial for maintaining tax compliance. Generally, a W-9 is required when earning income outside of traditional employment in the United States.

For instance, if you provide services to a company as a freelancer or contractor, they may ask for a completed W-9 form from you. The form allows them to report the payments they’ve made to you to the IRS using a 1099 form.

Another common situation is if you’re involved in real estate transactions. For example, if you’re a landlord and you receive rental income, you may need to provide a W-9 form to the property management company.

How to fill out the W-9 Form

A W-9 form is divided into different fields, each requiring specific information. Here’s a brief guide on how to complete each field:

- Name: Enter your legal name as it appears on your income tax return.

- Business name: If you have a business name that is different from your legal name, enter it here.

- Federal tax classification: Check the box that corresponds to your federal tax classification. This could be an individual, C Corporation, S Corporation, Partnership, Trust/estate, Limited liability company, or Other.

- Exemptions (codes apply only to certain entities, not individuals): Ignore this section if you are filing on behalf of yourself and not a company

- / 6. Address: Provide your current address. If your tax documents should be sent to a different address, note it in the field below.

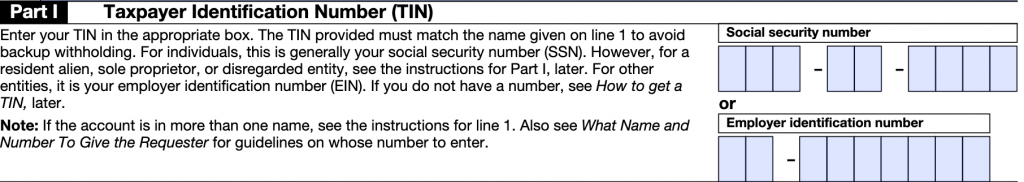

Taxpayer Identification Number (TIN): Enter your Social Security Number (SSN) or Employer Identification Number (EIN), as applicable in this part of the form.

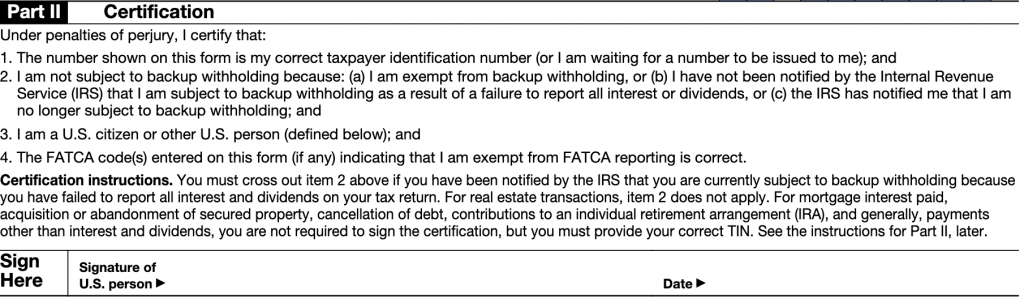

Certification: Read the certification carefully before signing and dating the form

Look out for these common mistakes

Filling out a W-9 form seems simple, but common mistakes can lead to unnecessary complications. Here are some errors to avoid:

- Not using your legal name: Always use your legal name as it appears on your income tax return. Using a nickname or an abbreviated name can lead to mismatches with IRS records.

- Incorrect federal tax classification: Make sure to select the correct federal tax classification. If you’re unsure, consult a Tax Professional.

- Incorrect or missing Taxpayer Identification Number (TIN): Your TIN could be your Social Security Number (SSN) or Employer Identification Number (EIN). Ensure it’s correct and clearly entered.

- Leaving fields blank: Complete all requested fields unless they are specifically stated as optional.

- Not signing the form: The W-9 form requires your signature to confirm that the information provided is accurate. Forgetting to sign invalidates the form.

Let’s avoid making the same mistakes as listed above! Remember always to double-check the information you’ve written on the form, as it will find its way to the IRS, so it needs to be accurate. Mistakes can cause not only errors when filing your taxes but also penalties. With that, always give it another look before giving it to your employer.

Special Considerations for Expats

As a US expat, it’s important to understand how your foreign status impacts the W-9 form. Despite living abroad, US citizens and resident aliens are generally subject to the same tax rules as those living in the US. You must still complete a W-9 form if you’re receiving US-sourced income.

However, there are a few nuances to consider. For instance, your foreign address may cause confusion for some requesters, as they may expect a US address. In this case, explain your expat status and provide your foreign address as usual.

Another important consideration is the Foreign Account Tax Compliance Act (FATCA). If your foreign financial institution requests a W-9 form, it’s likely due to FATCA regulations, which require foreign banks to report information about US account holders.

Need some help?

If you find the tax forms daunting or if you’re short on time, don’t hesitate to reach out to our team for assistance. Our experienced Tax Professionals specialize in helping Americans living abroad navigate their tax obligations. While it’s true that US expats have yearly tax responsibilities, MyExpatTaxes is here to simplify the process for you.

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

February 15, 2024 | Tax Forms | 4 minute read